As we enter 2025, the Melville Douglas team extends our warmest wishes to you and your loved ones. We hope you enjoyed a joyous and restful festive season. A new year brings with it fresh investment opportunities and challenges, and as always, we remain fully committed to navigating them alongside you with dedication and expertise. We sincerely appreciate your continued trust and partnership. Wishing you a happy, safe, and prosperous year ahead.

Staying the course: Another prosperous year for investors

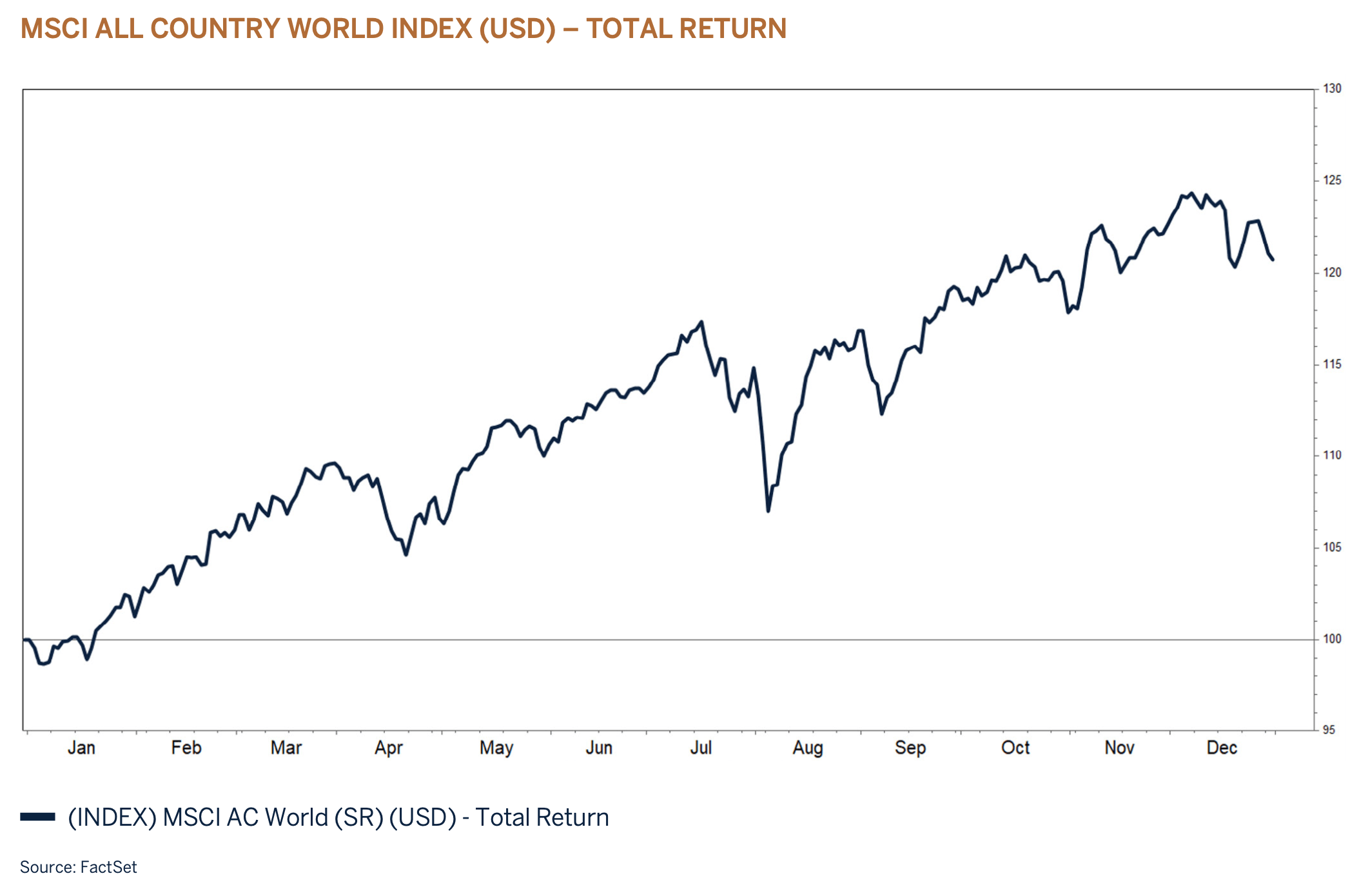

Led by US indices, global equity markets soared during 2024, fuelled by a confluence of favourable economic factors. Lower inflation has eased cost pressures, allowing businesses to operate more efficiently whilst also boosting consumer purchasing power. Simultaneously, a synchronised global interest rate cutting cycle has lowered borrowing costs, encouraging investment and spending across various sectors. This monetary easing has been particularly impactful in fostering a positive outlook for corporate earnings growth, as companies benefit from reduced financial burdens and increased demand for their products and services.

“Donald Trump’s recent US presidential victory looks set to build on the momentum of US assets outperforming the rest of the world.”

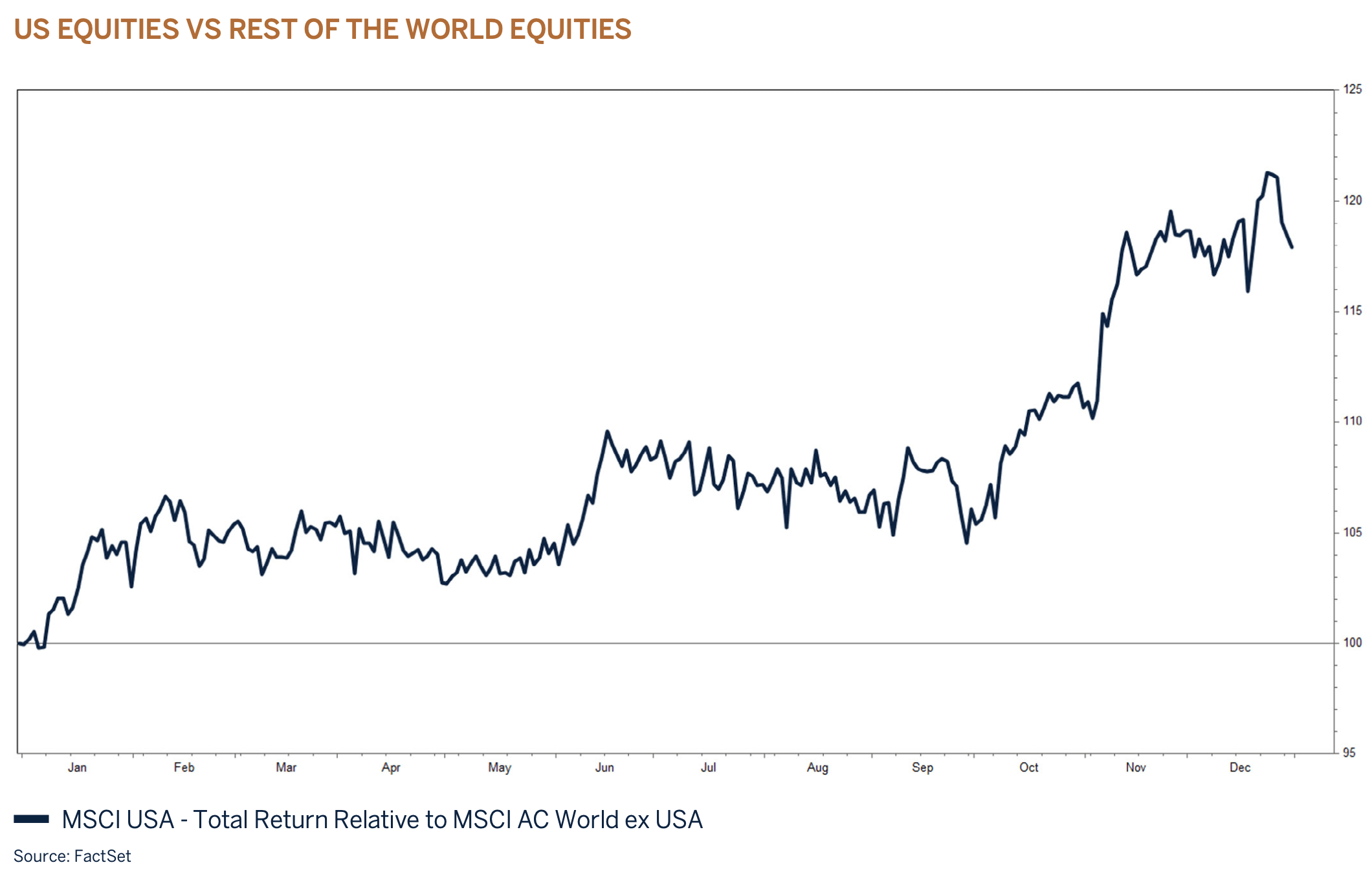

The impressive performance of the US economy has played a pivotal role in this upward trend. Robust jobs growth, rising wages, and resilient consumer confidence supported by the positive wealth effect of increasing asset prices have underpinned economic stability and expansion. This has not only bolstered domestic US markets but also had a ripple effect globally, enhancing investor sentiment and market performance worldwide. Consequently, the combination of these elements has created a fertile environment for equity markets, driving them to new highs and reflecting the strengthened economic fundamentals and optimistic prospects for businesses around the globe for the year ahead. Donald Trump’s recent US presidential victory looks set to build on the momentum of US assets outperforming the rest of the world. His policies of lower taxes, fiscal expansion, import tariffs, reduced regulation, and a softer stance towards Environmental, Social and Governance (ESG) integration are aimed at boosting the economy as well as business and consumer confidence. With a clean sweep across the House of Representatives and the Senate, it is viewed that Trump will have the necessary support from Congress to implement many of his stated policies. This political backing is expected to further stimulate economic growth, enhance corporate profitability, and sustain the positive trajectory of the equity markets.

Make America Great Again – 2.0

While 2024 will be remembered as the year of elections, with more than 100 countries accounting for nearly half of the global population voting, the outcome of the US election was perhaps the most closely followed by market participants due to the sheer size of the country’s economy and the US market’s dominance in global financial markets. Biden’s unexpected and late exit from the presidential race opened the door for Trump and the Republican party to secure a convincing victory over the Democrats. Trump’s policies are expected to benefit US corporations and taxpayers at the expense of their trading partners. However, the enforcement of import tariffs on global goods and restrictions on immigration could result in unintended consequences such as stickier or even an unwanted lift in inflation, significantly higher government debt, a slowdown in capital formation by the private sector, a deterioration in global trade, and supply disruptions of goods and services.

It is important for investors not to overreact to the potential outcomes of Trump’s stated policies, as the actual results are highly likely to differ significantly or be more moderate than what was communicated during the election period. Trump is an astute negotiator and is known for his transactional approach.

In its simplest form, newly elected President Donald Trump’s economic strategy aims to run the US economy like a business by implementing several key policies:

- Gaining competitive advantage: Trump seeks to boost American industries by imposing import tariffs, particularly on Chinese goods. This is intended to make imported goods more expensive, thereby encouraging consumers to buy American-made products. Additionally, he aims to lower the value of the dollar to make US exports cheaper and more competitive in the global market.

- Reducing costs: A significant part of Trump’s economic policy is to lower the corporate tax rate. He is expected to extend the Tax Cuts and Jobs Act of 2017 that he implemented in his first term which reduced the corporate tax rate from 35% to 21%. He has promised a further reduction from 21% to 15% for US businesses that onshore their operations aiming to increase corporate profits and stimulate investment in the US economy.

- Reducing frictions: Trump focuses on deregulation and removing unnecessary red tape, including rolling back environmental regulations, to reduce the compliance burden on businesses. This is intended to lower operational costs and increase efficiency, allowing businesses to operate more freely and profitably.

- Leveraging up: By increasing the budget deficit, Trump aims to stimulate economic growth through increased government spending. This approach, often referred to as fiscal stimulus, involves borrowing more to fund infrastructure projects, defence spending, and other initiatives that could boost economic activity.

- Cutting unnecessary expenditures: Trump advocates for reducing US contributions to international organisations like NATO, arguing that the US is bearing an unfair share of the financial burden. By cutting these expenditures, he aims to reallocate funds to domestic priorities.

These policies reflect a business-oriented approach to governance, focusing on competitiveness, cost reduction, deregulation, fiscal stimulus, and prioritising domestic over international spending.

At Melville Douglas, our investment approach remains firmly rooted to the fundamentals that determine the returns from carefully selected assets. However, we also find it insightful to examine how election outcomes can influence market dynamics. For instance, the US equity market (S&P 500) demonstrated robust performance during both Trump’s first tenure as president and Biden’s tenure. This suggests that while the outcome of an election and the incumbent’s policies are significant, they may not be the sole driver of equity returns. Over the long term, equity returns are more heavily influenced by factors such as profit growth and the discount rate applied to future cash flows. In other words, variables such as monetary policy, inflation, risk appetite, and valuations play a crucial role in shaping market performance. These elements can often have a more substantial impact on equity returns than the political landscape alone. As we navigate the complexities of the market, we remain committed to our fundamental approach, ensuring that our investment strategies are well-positioned to capitalise on opportunities and manage risks effectively.

Global conclusion

The global economic outlook remains positive, driven by monetary easing, credit growth, real wage growth, and productivity gains from AI. The divergence in growth and inflation between the US and the rest of the world is expected to persist, resulting in less aggressive monetary easing in the US compared to Europe, where growth has been lacklustre. Emerging markets look set to face challenges from a strong US dollar, higher for longer global bond yields, a weak Chinese economy, and uncertainties related to a new US administration.

President Trump’s policies, such as lower taxes, import tariffs, and the deportation of undocumented immigrants, could add inflationary pressures to an already buoyant US economy. The lack of detailed information and the ultimate implementation of these policies pose several risks to economic growth, likely leading to periods of volatility in global financial markets. If Trump succeeds, global trade could be significantly hampered given that the impact from his stated import tariffs is expected to be five times larger in US dollars than what was implemented in 2018/2019, and this does not incorporate the effects from retaliation and the effect on business confidence. However, given his reputation as a negotiator, we expect a more moderate implementation. What benefits the US may not necessarily benefit the rest of the world, so bouts of uncertainty and volatility should be anticipated. Federal Reserve Chair Jerome Powell recently highlighted this uncertainty regarding the impact on inflation and future interest rates, saying, “It’s not unlike driving on a foggy night or walking into a dark room full of furniture.”

We will continue to monitor developments as they unfold but will maintain our fundamental approach of investing in high-quality assets that offer attractive returns for our clients over the long term. With equity valuations becoming less supportive we are trimming our overweight equity positioning to neutral.

Global asset allocation

Global Equity - Overweight (moving to Neutral)

Equity markets have shown impressive performance over the past two years. Investors needed patience to participate in this rally amid significant volatility. A year ago, there was considerable uncertainty about the global economic outlook following one of the most aggressive interest rate hiking cycles in recent memory. Simultaneously, the war in Ukraine continued unabated, and a new conflict emerged in the Middle East.

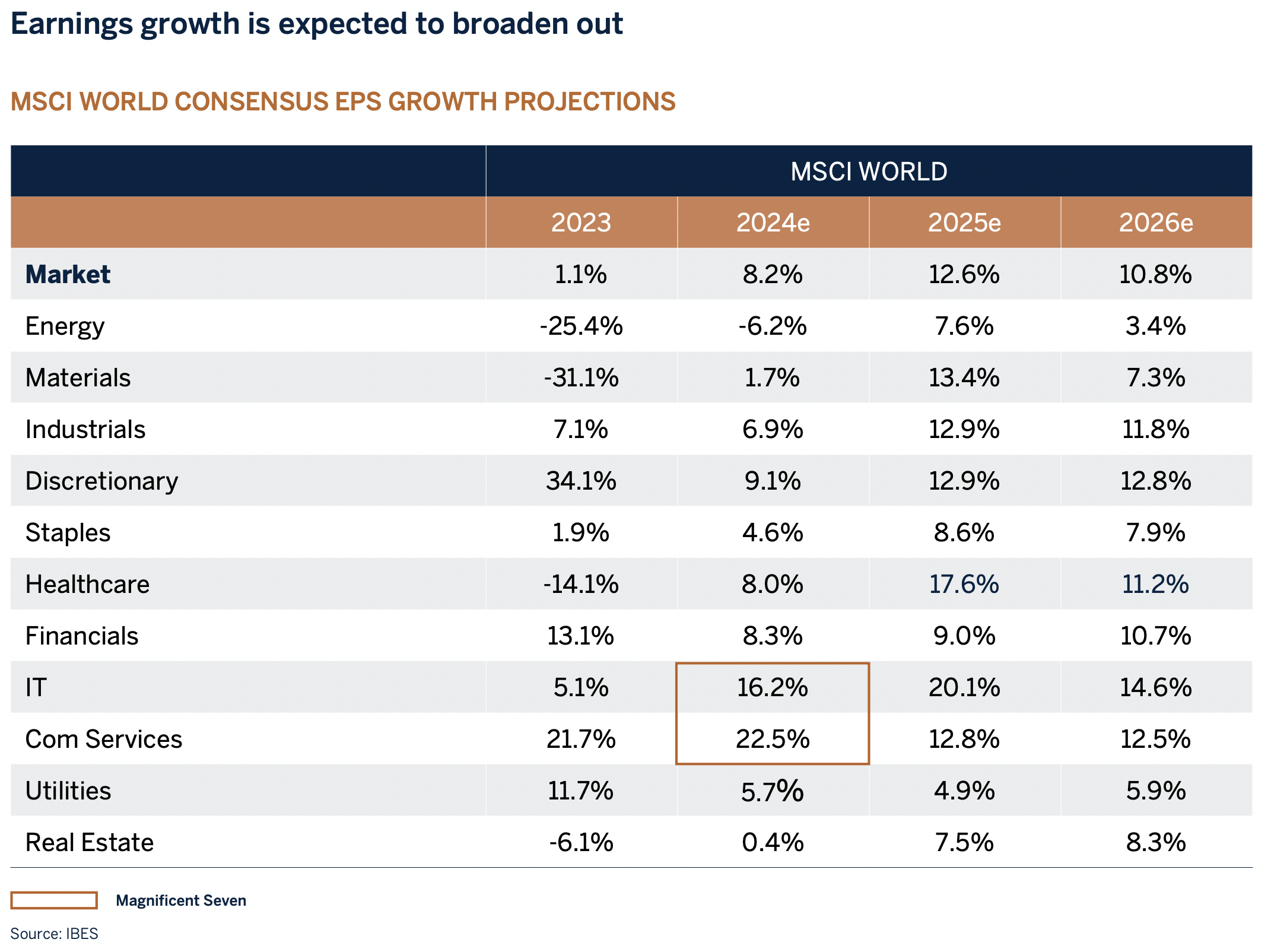

Until recently, earnings growth for global equity was primarily driven by rapid growth in Technology and the beneficiaries from Artificial Intelligence (AI). While we remain optimistic that the secular growth drivers for these industries will continue, it is encouraging to note earnings growth for the next year is expected to broaden out across a wider range of sectors, given favourable base effects, as the economic cycle gains momentum and the positive effects from lower interest rates emerge.

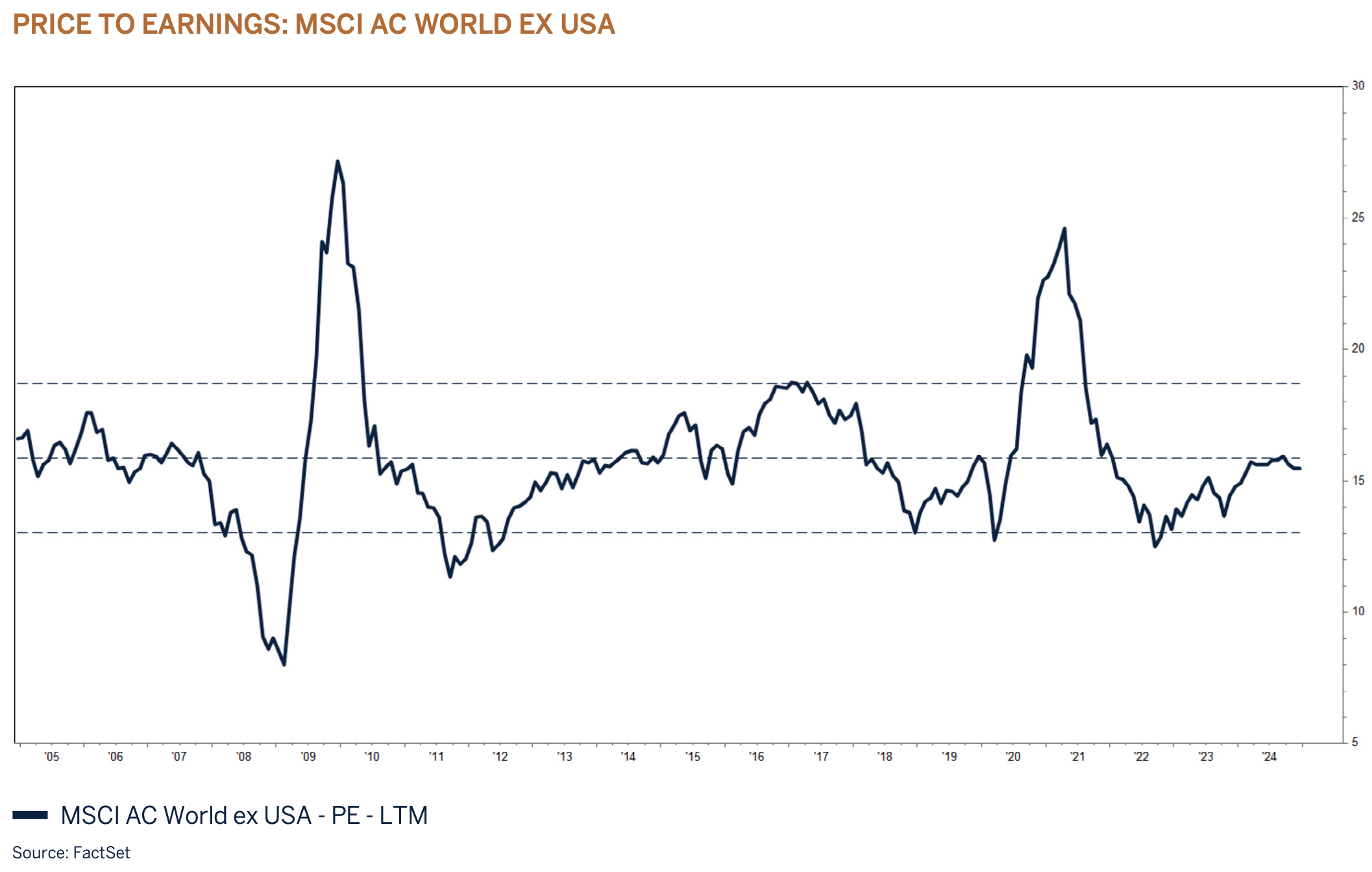

From a valuation perspective, global equity indices appear quite expensive. However, while we don’t claim that developed market equities are cheap, we believe there are valid reasons for the elevated levels of some indices, particularly in the US, and that investors should remain generally supportive, but selective, of this asset class as corporate earnings revisions turn positive and interest rates continue their downward trend.

The composition of indices has changed notably, with technology-related stocks now comprising nearly 42% of the S&P 500 index in the US, up from 8% in 1994. These stocks have been the primary drivers of global earnings growth over the past decade, especially since the pandemic began.

Beyond the discount rate (risk-free rate and equity risk premium) used for asset valuation, the rate of earnings growth and profitability are crucial determinants of equity valuations. Sustained growth in earnings per share (EPS) and return on equity (ROE) justifies higher valuations. This is why investors are willing to pay a premium for sectors or stocks with strong balance sheets, competitive advantages, and secular growth drivers, enabling them to grow faster than the average company. This trend is evident in equity markets such as the US, where secular growth stocks, including those in Technology, Communication Services, and certain Healthcare sectors like Biopharma, trade at a premium to their peers. The robust growth and improved profitability in these sectors have led to upward valuation adjustments across regions.

Additionally, when assessing valuations in regions outside the US, where Technology represents a smaller portion of equity indices, valuations align closely with long-term averages.

Therefore, while there are understandable reasons for some equities to trade at lofty levels at the start of the next earnings cycle upswing across a broader range of sectors, we anticipate that near-term returns from this asset class will now be driven mainly by earnings growth and dividends, as opposed to further earnings multiple expansion. We are cognisant that much of the positive expectations are already reflected in current valuations, leaving investors with lower margins of safety at current prices. As Warren Buffet wisely said, “Price is what you pay; value is what you get.”

Global Fixed Income – Neutral

The US Federal Reserve (Fed) initiated the easing cycle in September 2024 with an aggressive, and dovish, 50 basis point cut and has subsequently followed up with two additional 25 basis point reductions. A 1% reduction in interest rates was broadly expected in 2024, but the material change in the rate outlook for the year ahead was more unexpected—at least until Trump regained his seat in the Oval Office. The Fed’s December interest rate cut was deemed ‘hawkish’ and marked the return of the ‘higher for longer’ mantra. Whilst Trump’s victory brings with it upside risks to growth (tax cuts and deregulation) as well as downside risks (tariffs and policy uncertainty), the Fed’s more immediate concerns are with the latter, particularly as the inflation battle rages on. The Fed has raised its 2025 growth and inflation forecasts and lowered the outlook for unemployment, something it could not do without amending the interest rate outlook. The Fed now sees interest rates ending 2025 only 50 basis points below current levels, and the long-term neutral rate is now forecast to be higher at 3%. In essence, the Fed’s ‘immaculate disinflation’ strategy is now less clear given the improved growth outlook and risks that proposed tariffs ignite a global trade war—an environment that could put a floor under government bond yields (higher for longer), at least over the medium term.

No 2025 recession in the US is virtually consensus now; indeed, a reacceleration in economic activity is possible, and this comes off an already strong base, with the economy growing in the third quarter of 2024 at an annualised rate of 3.1%, thanks again to robust consumer spending, which remains supported by a strong and seemingly resilient employment market, real (after inflation) pay rises, and household net wealth hitting record highs. There are myriads of outcomes to Trump’s proposed tariffs, but for now, the market is focusing on the inflationary implications, and this comes at a time when prices—almost entirely in services—have entered another ‘sticky’ patch. Three-month annualised rates for both headline and core inflation have recently been moving in the wrong direction, a major issue for the Fed, which correctly remains insistent on bringing inflation down to target levels.

Weighing up these factors, it is not an environment that justifies materially lower bond yields, and as such, we forecast longer-dated yields to be at or around current levels in a year’s time, an outcome that would deliver a positive return. However, Trump 2.0 clearly poses risks to this view, hence our reticence to materially extend the maturity profile of our US dollar strategies just yet.

Cash Plus – Underweight

Cash and cash alternatives currently provide investors with favourable real yields and diversification. Having modestly revised our forecasts for inflation and interest rates higher—now expecting ‘higher for longer’ interest rates in the US—and with global equity valuations becoming less supportive, we are upping the weighting to Cash Plus in relevant client portfolios at the expense of equity.

South Africa

It’s all about execution, driving South Africa’s future

2024 was a tumultuous year, leaving asset price volatility in its wake. The year began on an optimistic note with global central banks expected to dial back on interest rates as early as the first quarter, as the battle against inflation seemed to have been won. However, this soon proved to be a difficult task, with inflation in the US re-emerging stubbornly, forcing policymakers to moderate market expectations through their forward guidance. In South Africa, the South African Reserve Bank (SARB) also adopted a cautious approach to its monetary policy easing stance, citing an uncertain global political and inflation backdrop.

After a robust post-GNU rally in the third quarter of last year, volatility emerged as South African financial markets mirrored the broader decline in emerging markets following Donald Trump’s victory in the US presidential election. Trump’s policies, particularly import tariffs, are seen as a global headwind, potentially leading to prolonged inflation and higher interest rates in the US, given a robust economic backdrop. The strong US dollar and higher-than-expected interest rates pose risks for emerging economies with substantial US dollar debt obligations. Although South Africa does not face the same level of concern, under Trump’s administration, economic growth will increasingly depend on the successful implementation of government growth reform policies, supported by private sector participation and initiatives such as Operation Vulindlela, which has moved into its second phase of supporting local government and municipalities with improving basic service delivery.

The economy can no longer rely on external handouts, preferential treatment, lower tariffs, or international funding, and monetary policy alone will not be enough to change the path to prosperity. This is especially the case in an environment where, as Christine Lagarde, President of the ECB, stated, “we are witnessing a fragmentation of the global economy into competing blocs, with each bloc trying to pull as much of the rest of the world closer to its respective strategic interests and shared values.”

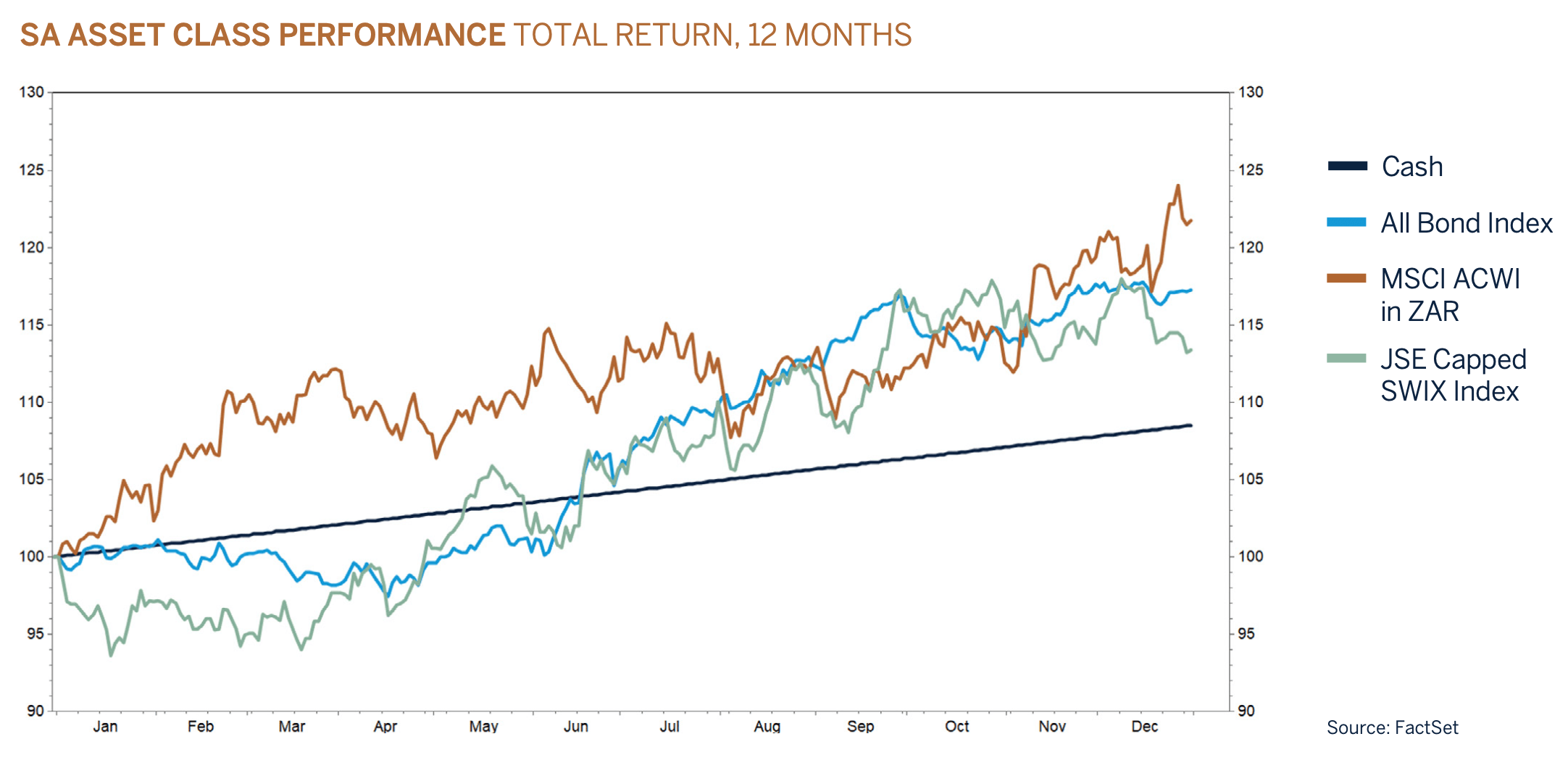

During the final quarter of 2024, domestic equities (JSE Capped Swix) fell by 2.1%, primarily due to a 9% drop in Resources on concerns related to the impact of import tariffs on China’s economy. Conversely, domestic bonds (ALBI) performed well, achieving a positive return of 0.4% despite significantly higher yields (lower prices) in developed market government bonds on the back of stronger-than-expected growth and inflation out of the US. For the second consecutive year, SA government bonds outperformed SA equities, delivering a return of 17.2%. However, domestically oriented stocks performed exceptionally well, with sectors such as Financials and Consumer Discretionary rising by 22.2% and 29.2%, respectively.

“After a robust post-GNU rally in the third quarter of last year, volatility emerged as South African financial markets mirrored the broader decline in emerging markets following Donald Trump’s victory in the US presidential election.”

2024 - A year of change

The year 2024 can be characterised as a period of significant change, marked by escalating geopolitical tensions, a synchronised interest rate cutting cycle across global central banks, and over 70 nations going to the polls. In emerging market economies, for the first time in a decade, the ruling party, BJP in India, lost the majority vote and was compelled to form a coalition government, causing investor uncertainty in one of the most populous democracies in the world. In a historic moment, Mexico and Namibia elected their first female presidents. Botswana’s ruling party of 58 years, the BDP, lost its majority vote, while the ruling Frelimo party in Mozambique retained its hold in what is flagged as a rigged election, culminating in protests as citizens demand transparency, accountability, and justice. After 30 years of democracy, the ANC in South Africa lost its majority and conceded defeat, resulting in the formation of a Government of National Unity (GNU). In the most anticipated election, Donald Trump made the greatest comeback in the history of American politics by winning the US presidential race, ushering in a new era of uncertainty with his policies.

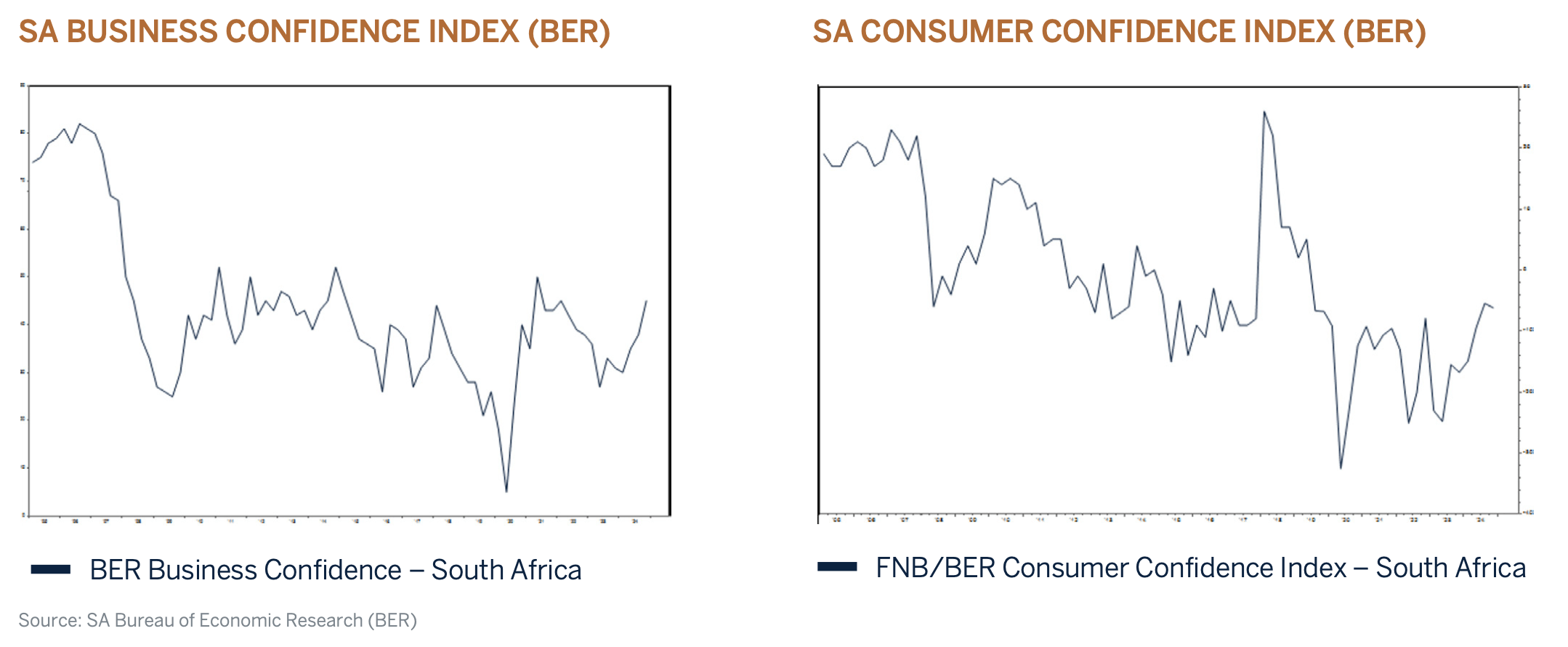

In South Africa, economic activity in 2024 began on a subdued note, with real GDP contracting by 0.1% in the first quarter. However, as the year progressed, a gradual and steady recovery was observed, with GDP growing by 0.4% in the second quarter. In the third quarter, GDP contracted by 0.3%, primarily due to a reported 28.8% decline in agricultural output. Looking ahead, a gradual uplift in GDP growth is anticipated. The improvement is expected to be driven by further easing in interest rates, significant cash injections from the two-pot retirement system withdrawals driving an increase in consumption, the stabilisation of electricity supply, and ongoing progress of structural reforms in critical infrastructure areas such as railway transport, water and sanitation, and ports. These factors are projected to boost both private and business confidence, with fixed investment expected to drive the economy alongside consumer spending in the medium term.

Why 2025 may not be a repeat of 2018

There are notable similarities between the positive performance of South African assets in 2024 and the experience of 2017. In both years, an improvement in the political and economic outlook led to a rerating of domestic asset prices. In 2017, the election of Ramaphosa as president of the ANC boosted market confidence, while in 2024, the formation of the Government of National Unity (GNU) propelled markets higher, although not to the same extent as in 2017.

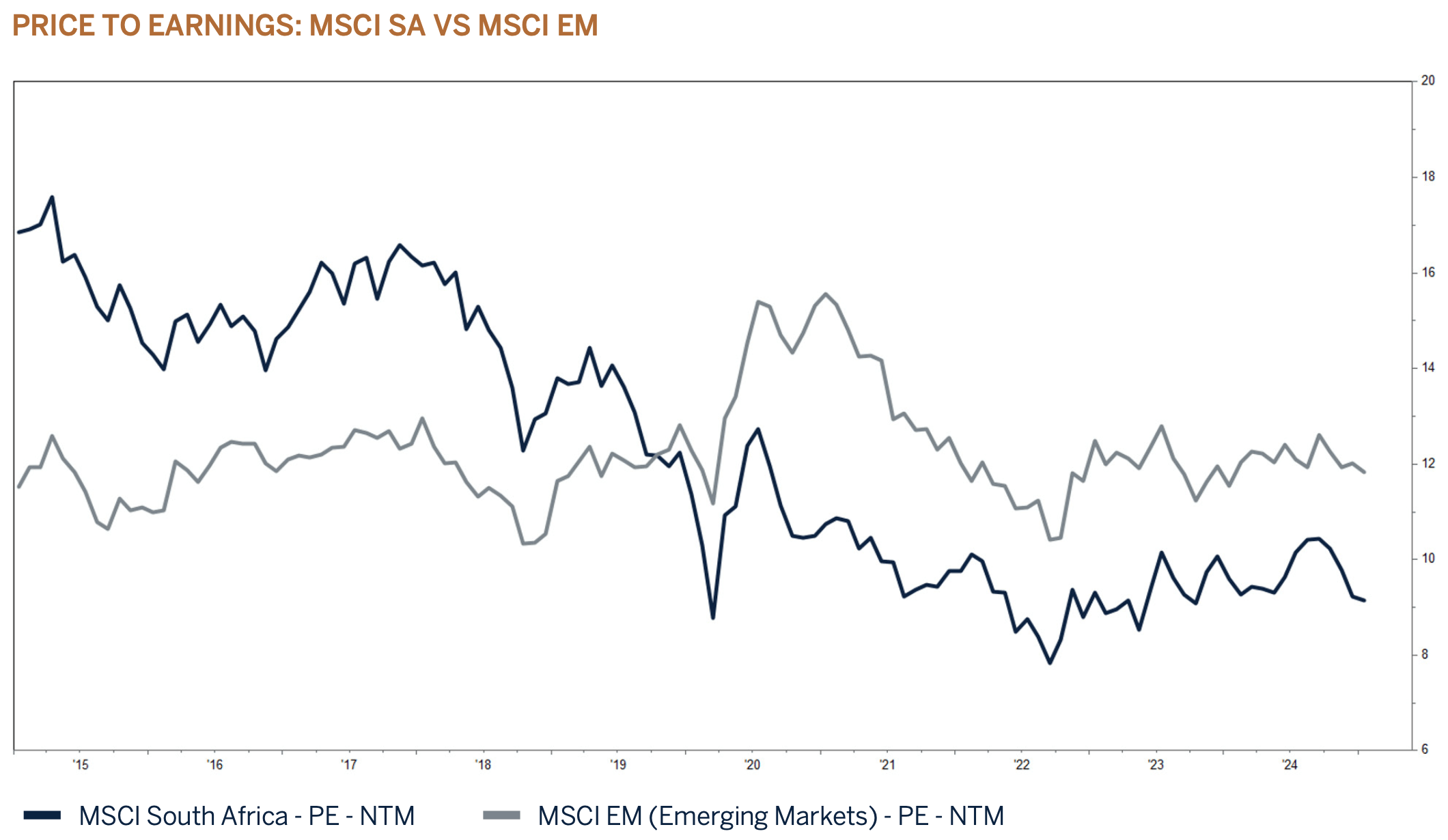

However, 2018 presented more challenges to global financial markets due to the introduction of tariffs on Chinese imports by the US administration. South African asset prices weren’t spared as valuation multiples de-rated and the government’s reform agenda disappointed. Trump remains determined to implement even more stringent tariffs this year, not only on Chinese imports but also on goods from Mexico, Canada, and other countries. This approach clearly poses a risk to business confidence, global trade, and the trajectory of financial markets. However, we believe that many of these concerns are already priced into the valuations of South African assets.

In a note to clients, RMB|Morgan Stanley recently issued a research paper highlighting key differences between the experiences of 2018 and the current outlook as we enter 2025, including:

- Valuations: The All-Share equity index is significantly cheaper on a 10.6x 12-month forward earnings now vs 16.9x at the end of 2017, and SA government bonds at 10.4% are yielding almost 2% more than at the end of 2017.

- Inflation and rates: Headline inflation in SA is currently 2.8% and the repo rate is 7.75%. In 2018, inflation was higher and interest rates were lower, making the case for further interest rate cuts this year.

- Competitiveness of the rand: The rand is 15% weaker now (real effective exchange rate) than towards the end of 2017, which may help cushion the risk of the currency depreciating on the back of an expected weaker Chinese Renminbi. Additionally, lower oil imports and better tourist receipts lend some support to the rand.

- Starting points: The SA economy is coming off a weak cyclical base, i.e., a favourable base effect, compared to 2017 when the economy was further into its economic cycle.

- Household cash-flow: An improvement in economic growth should underpin employment growth, while low fuel and food inflation will support real disposable income. In 2018, food inflation averaged 8% and fuel inflation 14%, negatively impacting disposable income and significantly higher than what is predicted for 2025.

- State-Owned Enterprise (SOE) performance: The outlook for both Eskom and Transnet is improving thanks to ministerial oversight, an anti-corruption drive, and new management. Over 2018, Eskom’s operational capacity dropped from 69% to 61% and Transnet rail volumes fell 5%.

- Business confidence and workers' perceptions: The BER business confidence index for the fourth quarter of 2024 (at 45) is already higher than the end of 2017 (33), and workers are confident in their ability to keep their jobs.

- Outlook for corporate earnings: Index earnings are low, and revisions have turned positive. The best for SA Inc. in 12 years, excluding the Covid rebound. Consensus earnings growth (MSCI SA) for 2025 is +24%, which sounds high but is from a low base and only 2.5% up on the end of 2021. This is in stark contrast to the negative earnings revisions over 2018.

- External accounts: SA is running a current account deficit of -1% (third quarter of 2024) vs -3% at the end of 2017. Lower oil import volumes, given improved performance at Eskom, plus easier regulation around tourist visas bode well for current account support into 2025.

Domestic conclusion

Although South Africa will not be entirely insulated from global events, we are optimistic that the renewed emphasis on implementing growth reforms with a focus on infrastructure improvements, coupled with increased private sector involvement and enhanced oversight and accountability from the Government of National Unity, will serve as a catalyst for transforming the domestic economy. This approach aims to elevate the economy to a more positive and sustainable growth trajectory, surpassing the historical performance experienced over the past decade.

With global equity valuations becoming less supportive, we are trimming our offshore equity positioning to neutral within our offshore portfolios. Meanwhile, we are maintaining an overweight position in South African equities and bonds within our domestic portfolios due to favorable valuations and an improved growth outlook.

Domestic asset allocation

Domestic Equity - Overweight

The positive and market-friendly outcome of the South African elections, resulting in the formation of the Government of National Unity, is anticipated to unlock shareholder value through the implementation of growth reforms and enhanced public/private sector partnerships. Currently, emerging market investors hold an underweight position in South Africa, but we foresee a shift in this allocation due to the improved economic outlook. This shift could lead to an increase in valuations, as South Africa is presently trading at an unusual discount compared to the MSCI Emerging Market peer group.

Domestic conclusion

Our strategy continues to focus on investing in high-quality businesses with strong balance sheets and robust cash flow streams. Given this approach, valuations remain supportive, and we anticipate an improvement in earnings growth momentum over the next year. This expectation is underpinned by favorable base effects, the potential for lower interest rates, and a boost in economic activity as confidence improves.

Domestic Fixed Income - Overweight

South African bonds have shown strong performance in light of the improved political environment, delivering attractive returns both in absolute and real terms. We expect this asset class to outperform cash over the next year, with our 12-month exit yield for South Africa’s 10-year bond projected at 10%. An enhanced growth outlook for South Africa, coupled with prudent fiscal management, could eventually lead to an upgrade in the country’s credit rating to investment grade, similar to the early 2000s. However, this is not our base case scenario at present.