Financial markets continue to trend higher as interest rates are lowered

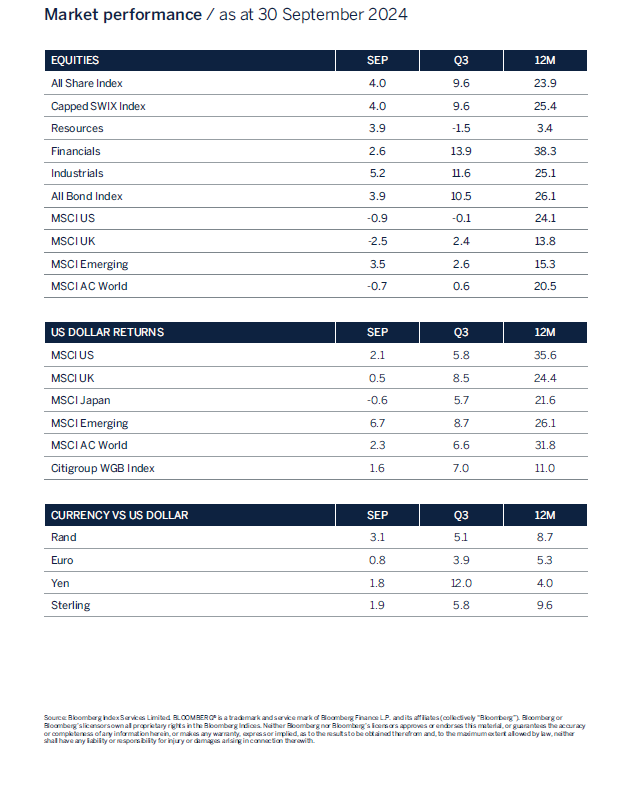

Financial markets have predominantly trended higher so far this year as inflation continues to drift closer to target, leading to hopes of lower interest rates and the increased chance of a soft economic landing or no landing scenario. Despite volatility during the summer months, caused by weaker employment numbers in the US, global equity markets concluded the third quarter with gains of 6.7% and 0.6% in USD and GBP terms respectively, as major western world central banks, as expected, commenced easing financial conditions by way of interest rate cuts. Heightened geopolitical tensions did not significantly impact this upward trend.

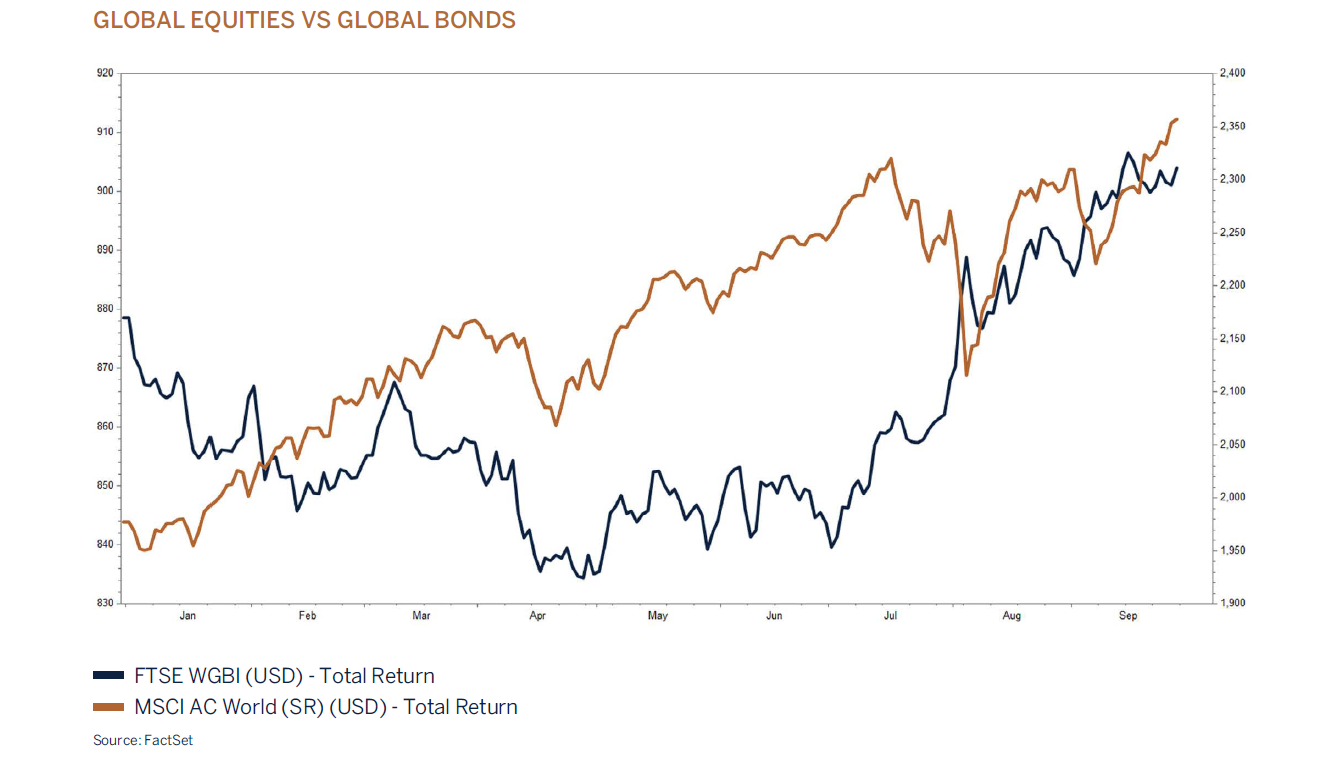

Global bonds also posted robust gains for the period, driven by economic growth concerns and lower-thanexpected inflation. This development allowed central banks to initiate a synchronised interest rate reduction cycle, following a period of stringent monetary policy aimed at combating inflation. Even China contributed by intensifying efforts to support its lacklustre economic growth and struggling property market.

Central banks will be satisfied with their progress in controlling inflation whilst maintaining employment and economic stability. Although central bank execution risk of taming inflation without causing recessions certainly persists, as the US economy cools, we remain optimistic about the outlook for financial markets. The current combination of lower inflation, partly due to reduced oil prices and normalised supply chains, robust consumption fuelled by real (after inflation) wage increases, declining interest rates, and strong balance sheets across both households and corporations, leads us to be constructive on markets, recognising that there are increasing chances of a “soft landing” being delivered.

US Federal Reserve’s strategic rate cut

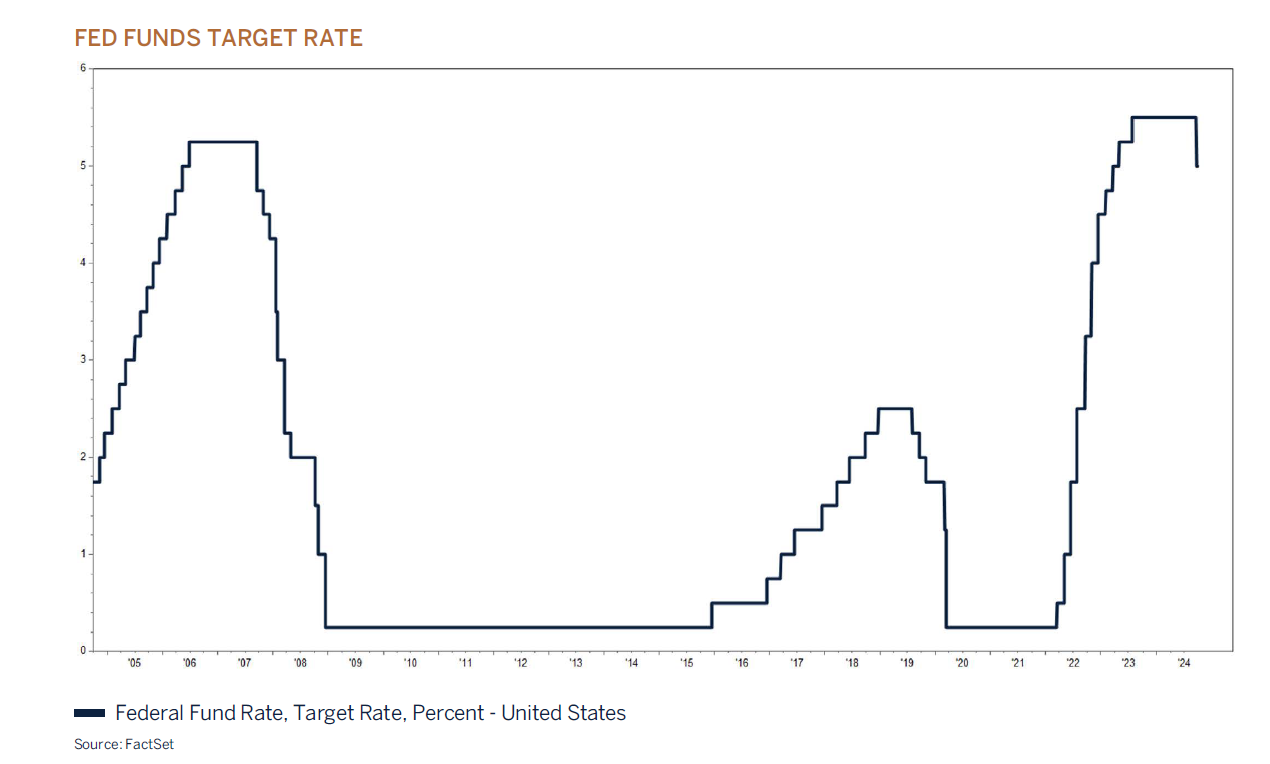

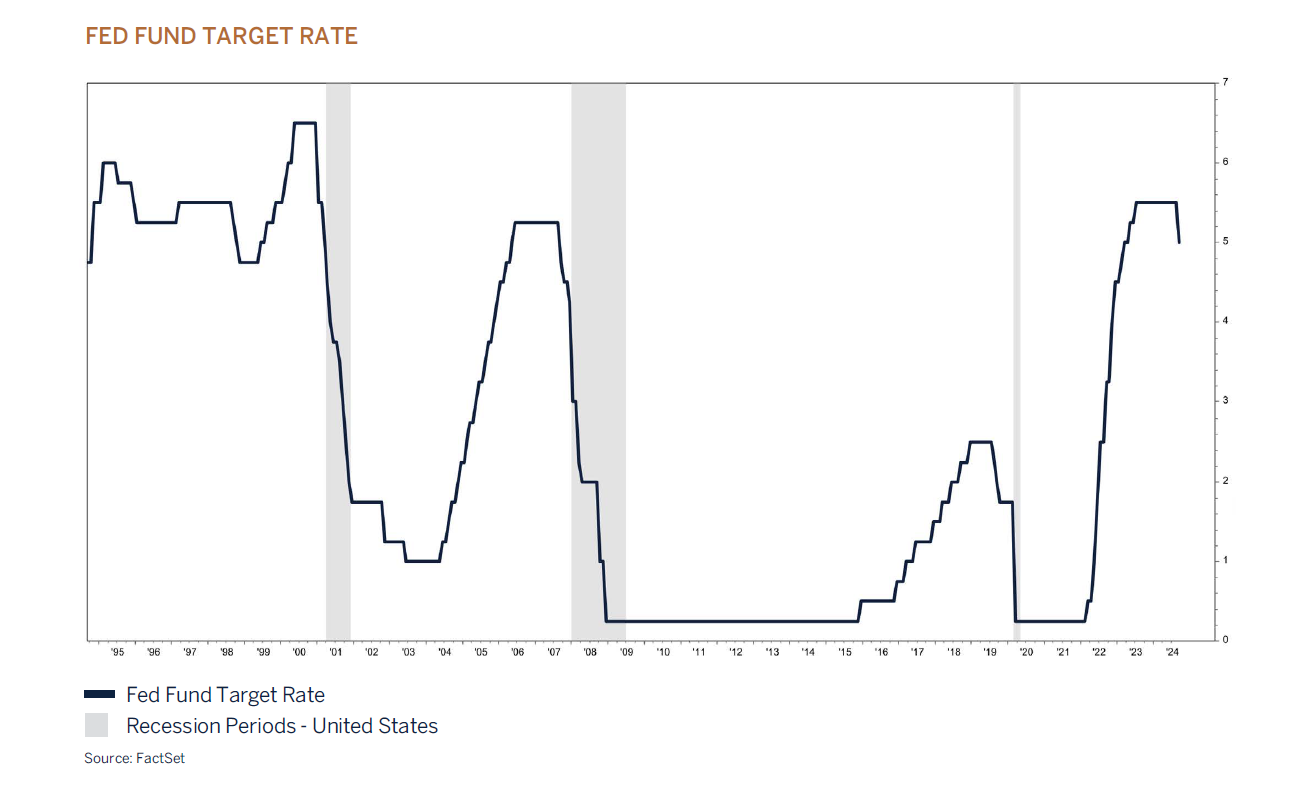

More than a year has passed since the US Federal Reserve’s (Fed) last interest rate hike in August 2023. Investors have been speculating about when the Fed would follow other major central banks in developed economies in cutting interest rates. Until recently, Jerome Powell and the Federal Open Market Committee (FOMC) have advocated for patience, as core inflation remained stubbornly high and growth, particularly in the employment market, proved resilient.

At the recent FOMC meeting in September, the Fed opted for a 50-basis points (bps) cut instead of the anticipated 25- bps. The most important takeaway for investors was the Fed’s assessment of the economy. “The decision reflects the Fed’s growing confidence that, with an appropriate recalibration of policy, strength in the labor market can be maintained alongside moderate growth and inflation moving sustainably down to 2%. This recalibration aims to maintain economic and labor market strength while enabling further progress on inflation as the Fed moves toward a more neutral stance.”

It was crucial for the Fed to emphasise economic strength to avoid any perception of panic with the 50-bps cut. Fed Chair Jerome Powell clarified that this move is not the new norm but a pre-emptive measure to signal the Fed’s commitment to staying ahead of economic challenges. The Fed believes the economy is in good shape, with growth expected to decelerate to around 2%, consistent with the US’s potential growth. Growth forecasts for 2024 were revised down slightly, with no changes from 2025 onwards. The Fed indicated a further 50-bps of cuts in 2024, followed by quarterly 25-bps moves, reflecting a gradual cutting cycle during 2025. Importantly, Mr. Powell reiterated that the Fed is prepared to act decisively if the economy deteriorates more than expected, reassuring investors that policy responses will be strong, thereby reducing the likelihood of significant sell-offs in risk assets.

However, it should be noted that the Fed’s outlook hinges on two main assumptions: that inflation remains under control and that the labour market does not deteriorate significantly. Like the Fed, we will continue to monitor these developments and stand ready to adjust our views if conditions change.

Stimulus measures and market optimism: China’s path to recovery?

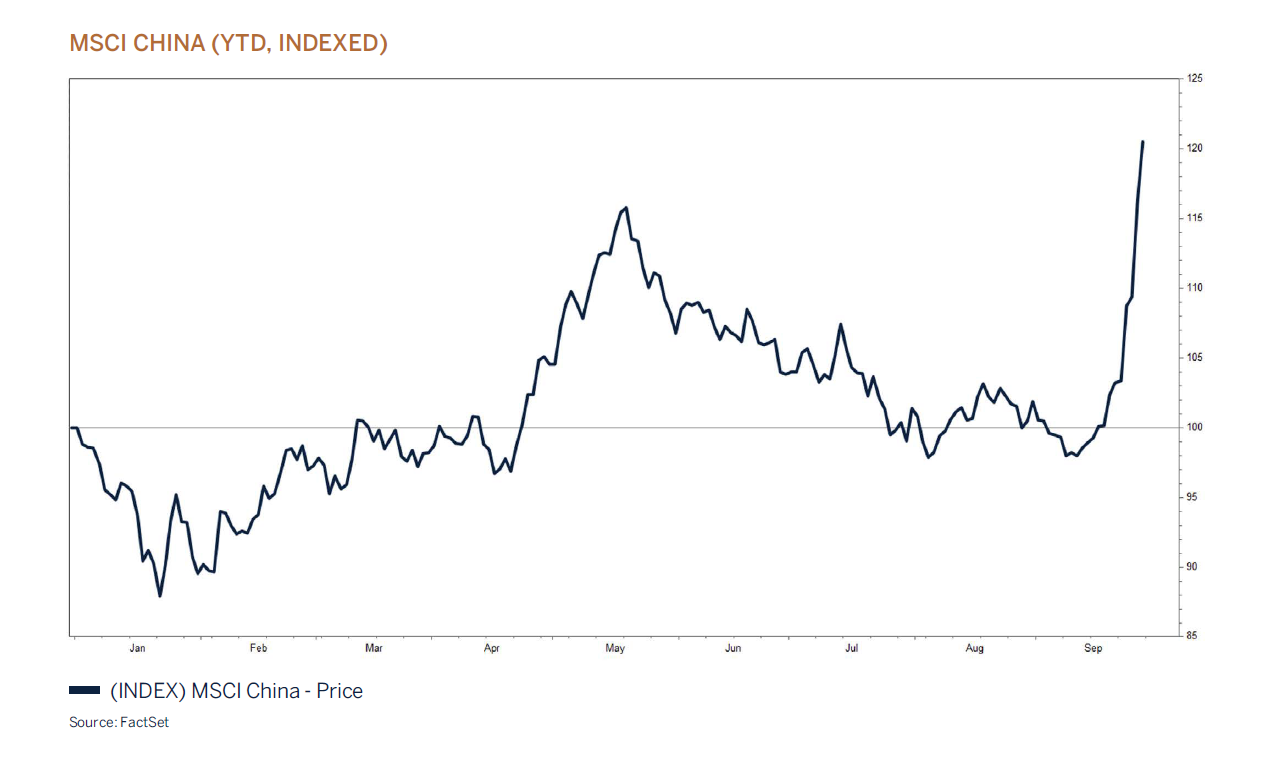

Since reopening post the pandemic, China has faced significant economic challenges, marked by declining domestic consumption and sentiment, leading to continuous downward revisions in GDP growth and commodity demand. Until recently, the outlook for China appeared increasingly bearish, with Chinese equities and base metals priced for failure. The demand side has been particularly weak, with property sales down, rising savings rates, increasing youth unemployment, and low consumer confidence, reflecting pessimism in the world’s second-largest economy. Given China’s substantial share of global commodity demand, it is unsurprising that their subdued economic data has had a ripple effect on commodity prices, with gold being a notable exception. Gold has outperformed, benefiting from global uncertainty, the People’s Bank of China (PBoC) accumulating gold, and Chinese consumers turning to gold as a safe haven asset instead of real estate.

Recently, however, there has been a shift in policy aimed at providing much-needed support to the Chinese economy by boosting domestic economic activity, stabilising the real estate market, and supporting equity market prices and consumer confidence. China announced a stimulus package to inject one trillion yuan into the economy, along with accommodative measures such as cutting lending rates, mortgage rates, and down payments on property, and supporting share buybacks for domestic equities. The Chinese currency, equities, and commodity markets have all responded positively to these proposed policy reforms, with aggressive short covering further propelling these markets higher.

The government’s renewed urgency has captured market interest, as the extensive stimulus measures across all facets of the economy are perceived as a “whatever it takes” approach to revitalise China.

While these measures are positive from a liquidity perspective, especially with global central banks cutting rates, the sustainability of the recent aggressive rally remains in question. Economic improvement will not happen overnight, as the stimulus measures take time to take effect, and the government works through elevated property market inventory. Following the Politburo meeting, key execution points to monitor in the coming months include controlling new property supply, optimising housing inventory and quality, and implementing supportive measures for idle land.

Labour market developments will be key

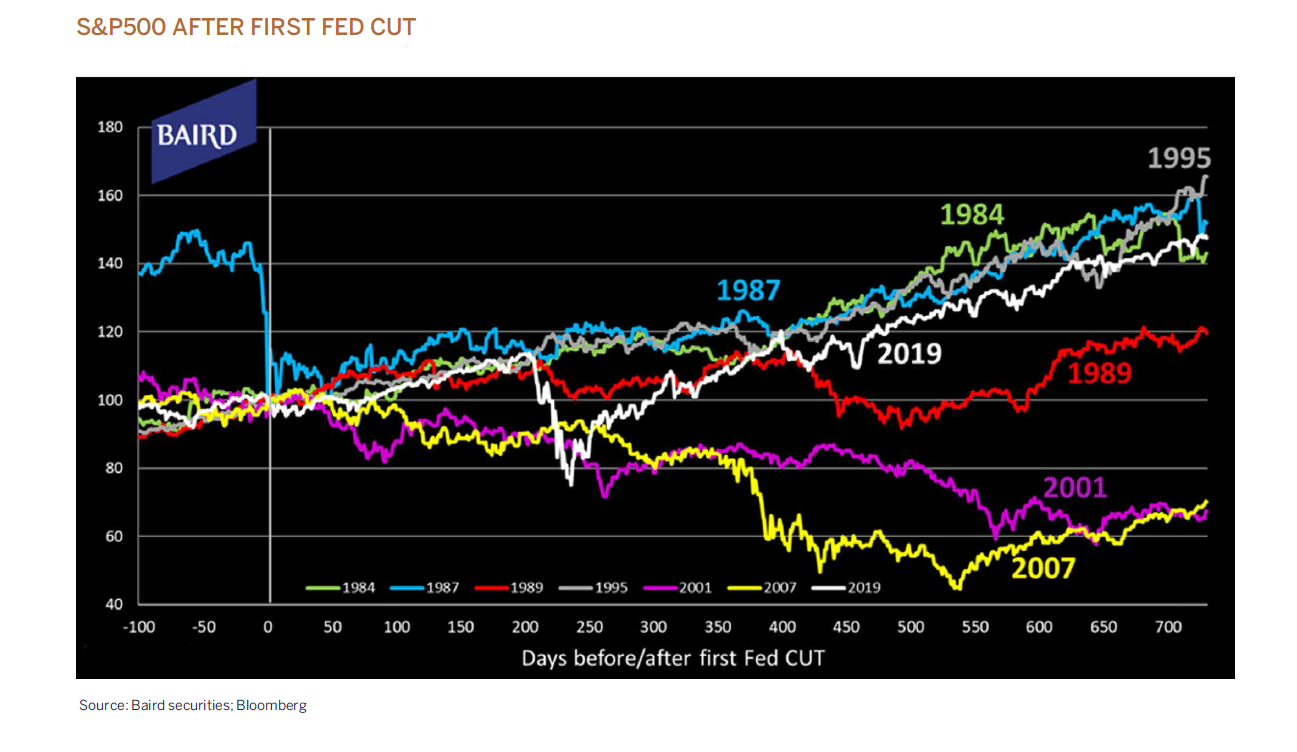

The US economy is expected to moderate over the next year as employment and wage growth normalise following a period of unsustainably high expansion. It can be prudent to “sell the first cut” as central banks provide relief when economies face increased uncertainty, typically resulting from the delayed impact of high interest rates.

However, it is crucial to distinguish between environments where monetary easing was necessitated by financial dislocations or imbalances—such as asset bubbles (dotcom era), stretched balance sheets and reckless lending practices (Global Financial Crisis), excess capacity following aggressive capital formation or employment growth, and unexpected events like wars or oil shocks (1987) — and periods when interest rates are reduced due to disinflation, as we are currently experiencing. The latter tends to be positive for both equities and bonds, and from the current level of interest rates the Fed has plenty of ammunition to support the economy if required.

Global conclusion

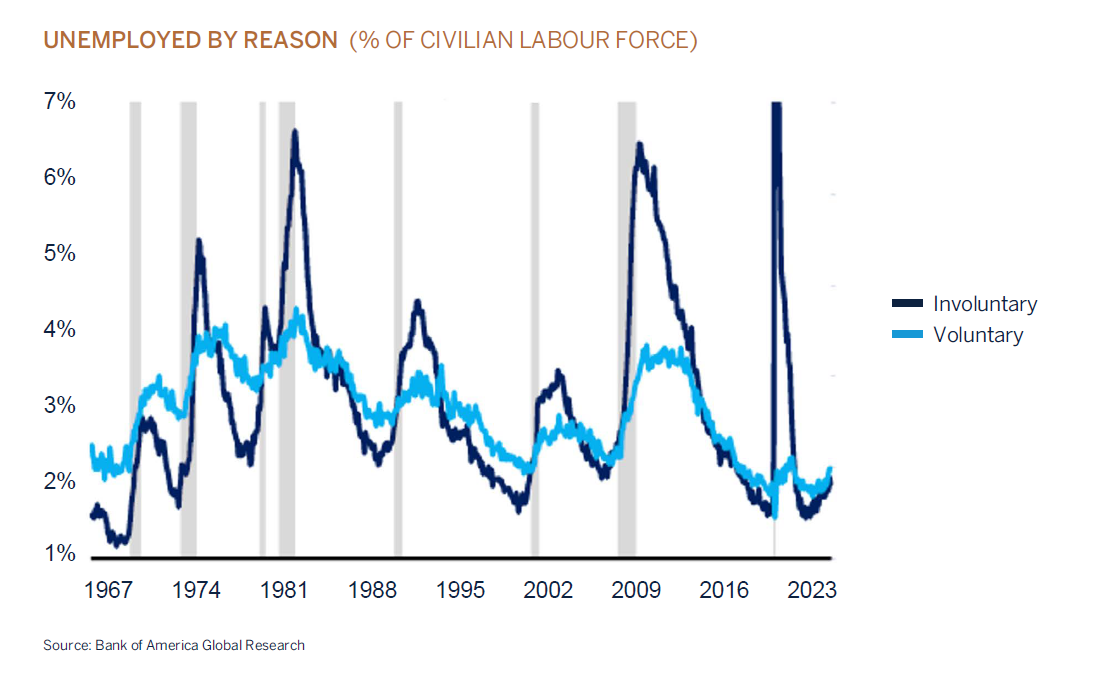

While we maintain a constructive outlook for the global economy, we are mindful of developments in the US employment market. Employment growth has been revised downward and is trending towards pre-COVID (normalised) levels that are in line with long-term trends, and consistent with the low levels of jobless claims. However, the moderation in the job market has been characterised by low job losses while vacancies remain elevated. In addition, nearly half of the increase in the unemployment rate has been due to voluntary (job leavers) rather than involuntary (layoffs) unemployment.

Additionally, job cut announcements are down from a year ago despite sizeable layoff announcements in tech and finance this year. We are also relatively optimistic on the outlook for layoffs since we have not seen significant over-hiring in this cycle.

We are closely monitoring these trends for any signs of weakness, as aggressive layoffs could disrupt the benign outlook for economic growth due to the negative feedback loop between weakening consumption and a weakening labour market.

Despite the trends within the labour market, economic data and final demand remain resilient, allowing us to maintain a positive outlook on financial markets. The global environment of synchronised declining interest rates is expected to support consumption, investment spending, and liquidity. Coupled with lower oil prices, reduced inflation, and positive corporate earnings revisions, this bodes well for equity markets, justifying our tactical overweight position in this asset class.

As we approach the 60th US presidential election, increased volatility is anticipated as candidates vie for the presidency. This is not unusual and may present opportunities for patient, long-term investors. At Melville Douglas, our portfolios are well-diversified across various asset classes, sectors and stocks ensuring they are well-positioned to navigate any outcome.

Global asset allocation

Global Equity - Overweight

2024 is a landmark and potentially seismic year for general elections. Almost half the world’s population, an estimated 3.7 billion people, will have cast their votes by the year-end, in over seventy countries, including the US, UK, India, and South Africa.

Governments come and go in democracies; the Indian and South African elections saw modest near-term market volatility before investors moved on to other matters, whilst in the UK Labour’s landslide win was well flagged and already fully discounted by markets. Broader economic developments usually have a far more significant impact on market outcomes than politics.

To allow for election uncertainties, the Melville Douglas Global Equity Fund is diversified by country, sector, and investment themes.

The outcome of an election is just one of multiple factors in our investment process, and by their nature election results can be uncertain. Whilst we do not speculate on a particular political outcome, we do assess whether we are taking significant intentional or unintentional political bets. While we are aware of these risks, our investment decisions are driven by a company’s long term fundamental prospects on a bottom-up perspective rather than from a top down or political view.

Geopolitical fears often lead to sharp, short-term selloffs, typically followed by a relatively quick recovery. These events are inherently difficult to time consistently. At Melville Douglas, we rely on in-depth, in-house research to guide all our investment decisions. We prefer investments and strategies that exhibit strong and predictable growth, and that are led by competent management. At the end of the day, we target predictable returns at the appropriate level of risk. We achieve performance by avoiding investments with high downside risk and low returns on capital through the business cycle. Only when we have thoroughly understood the drivers of the investment opportunity, do we decide on whether to invest in it. By doing so, we protect our clients’ wealth from permanent loss of capital during temporary market noise while generating attractive investment returns over the long run.

Equity valuations

On the face of it, equity valuations are not particularly attractive, primarily due to the high value assigned to high earnings growth sectors and stocks in the US. However, outside the US, valuations are in line with long-term averages and the US market appears fairly priced on a price-to-free-cash-flow basis. We expect valuation multiples to de-rate over the medium term, but in the short term, given declining interest rates, they could remain elevated. Historically, equity valuations have only contracted during recessions and short-term equity returns are more linked to earnings growth momentum than valuations, hence our tactical overweight position in the asset class.

Global Fixed Income – Neutral

Global bond markets delivered strong returns in the third quarter as further evidence that the disinflation trend remains intact convinced major central banks to commence easing monetary policy. In a highly anticipated move, the US Fed lowered interest rates by 50-bps to 5% and signalled a further 50-bps of easing before year-end. The Fed’s goal is clear, namely glide the US into an economic soft landing by pre-emptively easing whilst, on many measures, the economy remains strong. As ever, the future pace of monetary easing will be dictated by the economic data but getting ‘ahead of the curve’ in this way should be seen as growth positive, although it is not without upside inflationary risks. Given expectations of higher UK inflation into yearend, the Bank of England (BOE) opted to keep interest rates unchanged at their September meeting having cut by 25-bps in early August. And in the Eurozone, the European Central Bank (ECB) sanctioned two 25-bps cuts, taking the key deposit rate to 3.5%. Inflation continues to edge closer to 2% and concerns over the health of the economy continue to build with the ECB trimming its annual growth forecasts out to 2026.

We do not anticipate bond yields to decline significantly from current levels, given the benign outlook for the global economy. Before the Global Financial Crisis (GFC), bond yields provided investors with attractive real yields (150 – 200-bps), and we see no reason this should not be the case going forward.

Our neutral recommendation is based on the expectation that the asset class will deliver returns ahead of cash over the medium term as interest rates decrease. Additionally, maintaining a neutral weight provides insurance against the risk of a worse-than-expected economic outcome.

Cash Plus – Underweight

While cash and cash alternatives currently provide investors with favourable yields and diversification, we remain underweight, favouring equities, which are better positioned as interest rates decline over the next year.

South Africa

So far so good!

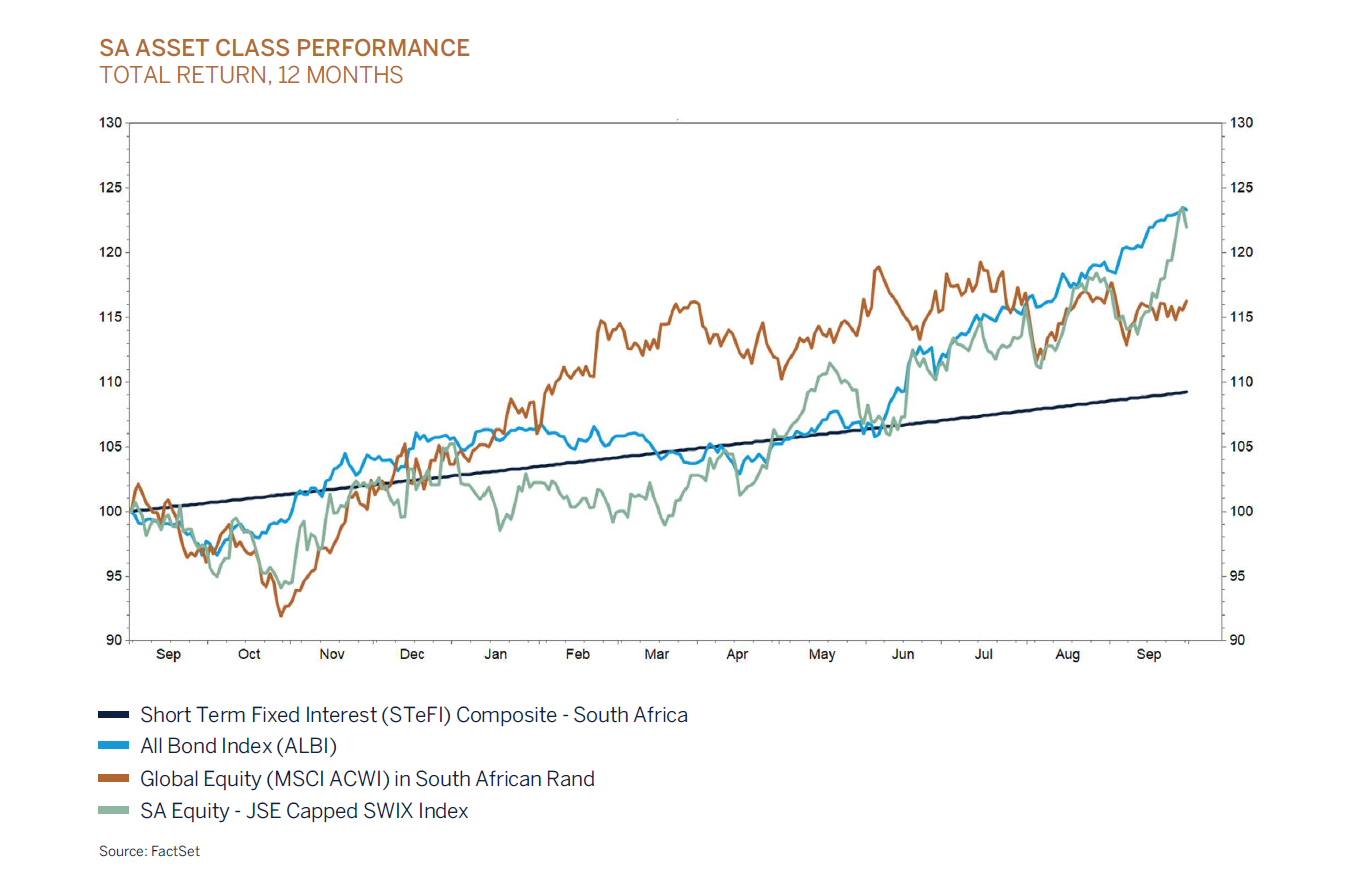

In the 100 days since the implementation of the Government of National Unity (GNU), South Africa’s financial markets have responded positively. We have observed a reduction in country-specific risk, leading to an appreciation in the local currency and buoyancy across all asset classes. During this period, the Rand has gained 5.8%, the JSE All Share Index has risen by 8.8%, and bonds have surged. Consequently, South African financial markets have been among the best performers over the past year, with bonds and equities returning 26% and 24% respectively, outperforming global equity markets (MSCI ACWI) when converted to Rand. We anticipate this trend to continue in the near term.

Attributing the recovery of the local currency and domestic financial markets solely to the positive political backdrop would be inaccurate. The recovery has also been driven by benign inflation and interest rate outlooks, as well as the actions of central banks. With the synchronised global interest rate cutting cycle underway, the South African Reserve Bank followed suit with a 25bps decrease in the repo rate after inflation printed below the target midpoint of 4.5% for the first time in over three years.

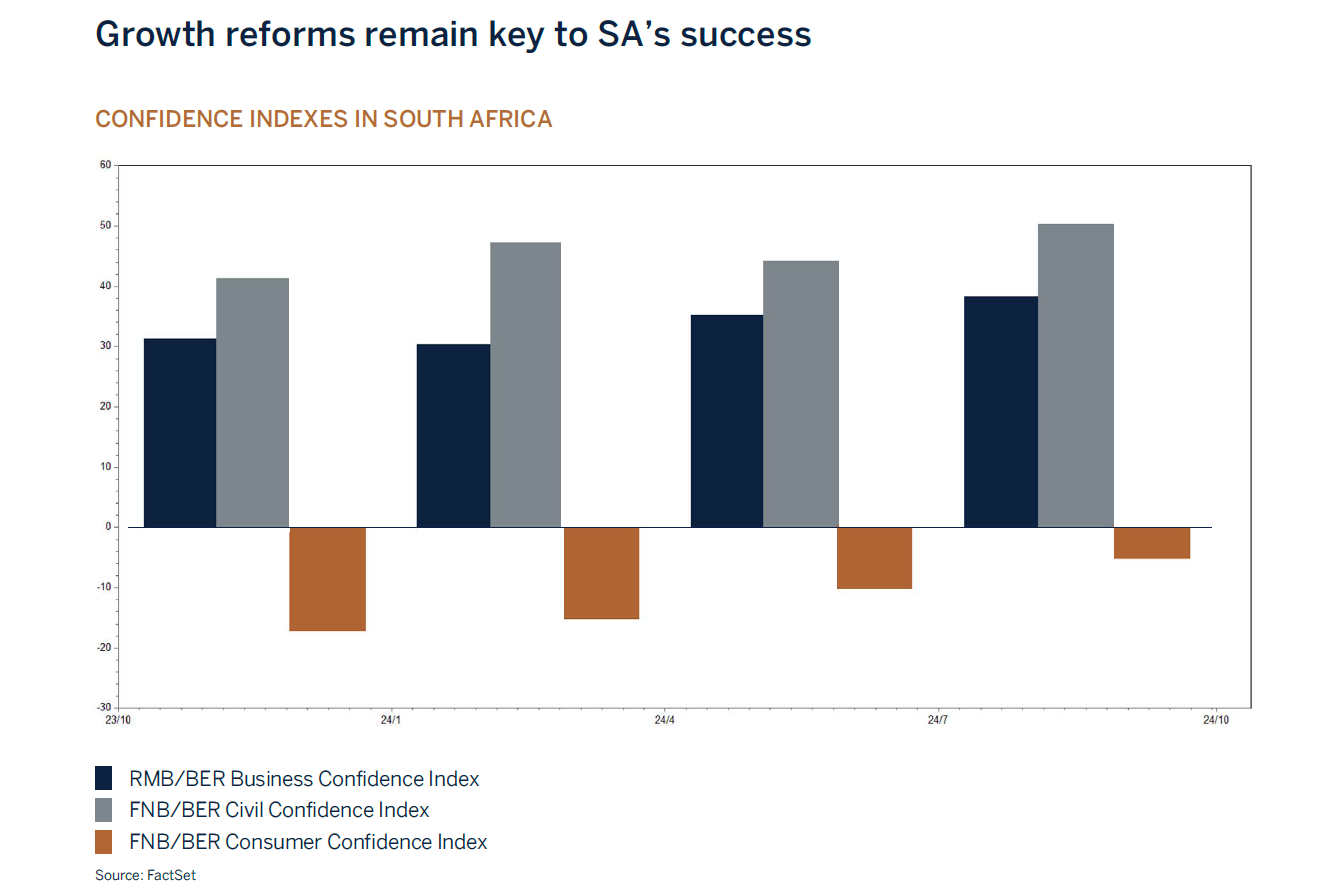

One of the most encouraging aspects since the formation of the GNU, has been the improvement in confidence among consumers, business and the construction industry. Something which has been lacking for some time and if sustained will assist in moving the economy onto a different growth trajectory alongside the implementation of government’s growth and reform initiatives.

President Ramaphosa’s near-term growth ambitions for the economy may not be as far-fetched as some believe. The President has called to turn South Africa “into a construction site” to rebuild the country’s infrastructure after years of neglect. With collaboration from the private sector, the economy could achieve a 3.3% growth rate by the end of 2025.

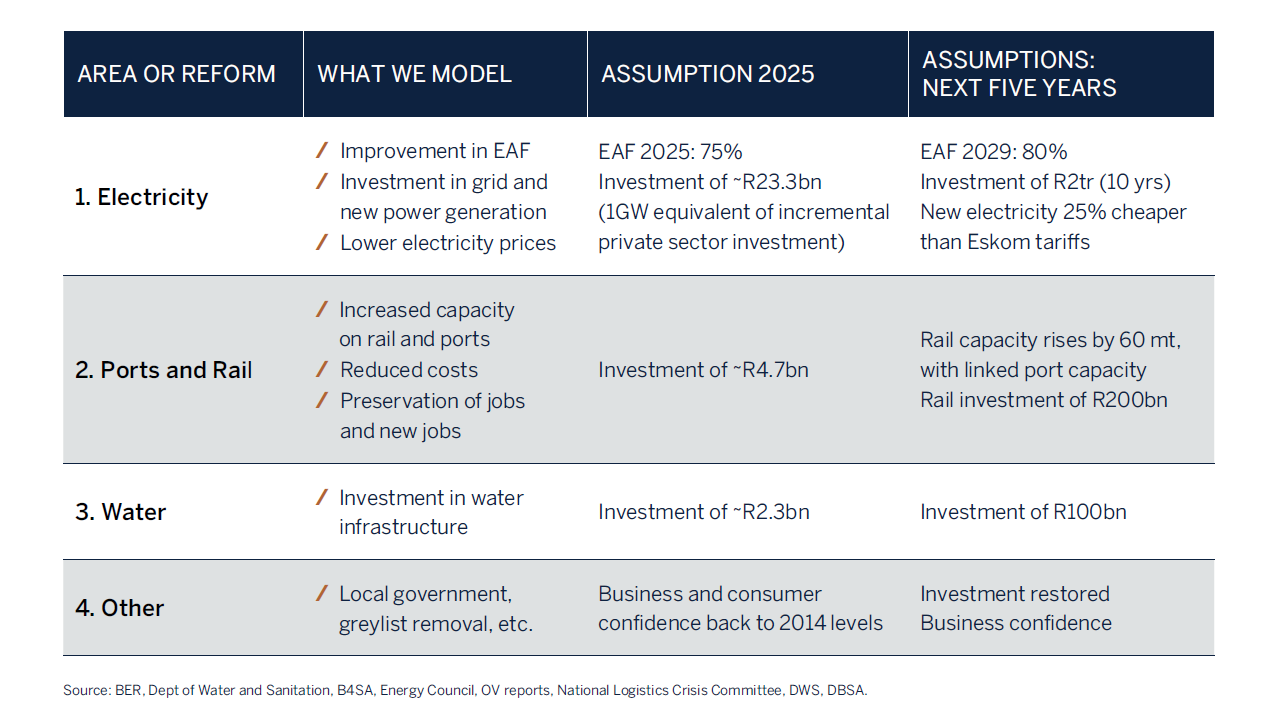

In a recent report titled “What we need to jump-start economic success” the Bureau for Economic Research (BER) indicated that while their base case is for the SA economy to grow by 2.2% in 2025, 3.3% GDP growth is achievable if the economic reforms are implemented immediately, by prioritising the following areas:

- Electricity reforms

- Port and rail reforms

- Water

- Crime, corruption, governance, and other reforms

According to their analysis this package will lead to:

- Growth of over 3% by 2025 and a sustained increase in growth to 2029

- More than 130 000 additional new jobs every year (job growth increases by 2.1% a year)

- Nearly 1m additional new jobs by 2029

- Favourable inflation impacts from lower electricity and transport prices, support a repo rate cut

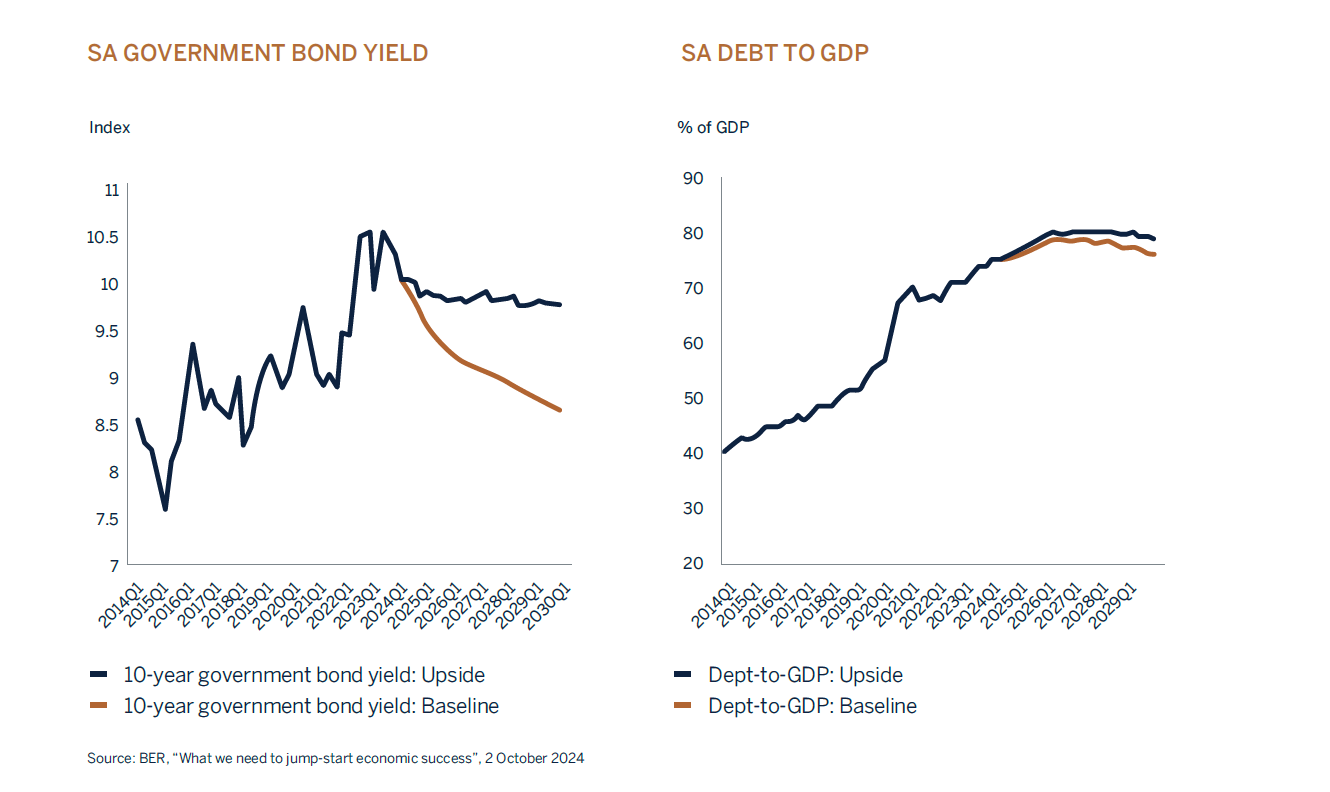

An improvement in the country’s growth fortunes will have a material effect on South Africa’s fiscal health, with Debt-to- GDP expected to decline, reducing government borrowing costs (10-year government bond) to below 9% by 2026/27 as the country’s sovereign risk premium narrows to levels last experienced during 2014-2016.

Asset prices stand to benefit from these developments, given that growth and the discount rate (required rate of return) are the two most important inputs in valuing assets. While we are starting to see positive revisions to corporate earnings from consensus, we believe more is in store, given that the earnings growth to real GDP multiplier for South African equities has historically been between 4-5x.

Domestic conclusion

We remain firm in our belief that valuations for the domestic equity and bond markets remain attractive. Growth-supportive policy reforms, a sustained decline in interest rates, receding inflation, efficiency improvements in ports and rail infrastructure, and stability in energy generation and transmission will collectively bolster the South African economy and contribute to the stability of financial markets over the medium to long term. Most foreign flows remain meaningfully underweight South Africa. We believe there is potential for continued meaningful inflows from Global Emerging Market investors, with an understanding that the market will take a cautious approach to investing in South Africa. With attractive valuations and the potential for improved growth, we remain overweight South African assets.

Domestic asset allocation

Domestic Equity - Overweight

The favourable and market-friendly outcome from the South African elections with the formation of the Government of National Unity is expected to unlock value for shareholders as growth reforms are implemented through various initiatives and greater public/private sector partnerships. Emerging Market investors currently hold an underweight position to South Africa, however, we expect a shift in this allocation due to the improved economic outlook. This could result in an uptick in valuations, given that South Africa is currently trading at an unusual discount to the MSCI Emerging Market peer group.

Our strategy remains to invest in high-quality businesses with strong balance sheets and robust cash flow streams. With that in mind, valuations remain supportive, and we expect an improvement in earnings growth momentum over the next year, underpinned by favourable base effects, lower interest rates, and an improvement in economic activity as confidence improves.

Domestic Fixed Income - Overweight

South African bonds have demonstrated robust performance following the improved political environment, offering attractive returns/yields in absolute and real terms. We anticipate that this asset class will outperform cash over the next year. Our 12-month exit yield for SA’s 10-year bond is 10%.

An improvement in South Africa’s growth outlook, alongside prudent fiscal management, could eventually lead to an improvement in the country’s credit rating to investment grade, as was the case in the early 2000s. This is not our base case at present.

Global Equity – Neutral

The global economic backdrop remains resilient, though some softness is emerging in the labour market. The outlook for the global economy is unchanged, with the baseline view that global growth over the short to medium term will align with trend growth, supported by monetary accommodation as inflationary pressures subside. The no-recession view is critical for the global equity outlook. If rates are cut due to disinflation, positive returns should be expected.

Earnings growth is expected to broaden out to other sectors. Base effects are favourable and operating cost pressures are expected to subside as labour costs moderate in line with lower inflation and as the job market cools off after a period of unusually strong growth in developed markets. In addition, global earnings revisions have once again turned positive.

Valuations however are not as attractive compared to history, but this is predominantly a function of the value assigned to high earnings growth sectors/stocks in the US. Outside of the US, valuations are in line with long term averages.

We have a neutral exposure to Global Equity in domestic portfolios due to our tactical overweight position to SA assets.

Global Fixed Income – Underweight

The global synchronised interest rate cutting cycle is now underway, with all major developed market central banks (excluding Japan) lowering interest rates as inflationary pressures subside. More cuts are expected over the next 12-18 months as interest rate policies recalibrate to support growth and strengthen the labour market. We do not anticipate bond yields to decline significantly from current levels, given the benign outlook for the global economy.

SA Cash – Underweight

The favourable and market friendly outcome from the South African elections with the formation of the Government of National Unity is expected to unlock value for shareholders, as growth reforms are implemented through various initiatives and with greater public/private sector partnerships. Emerging Market investors currently hold an underweight position to South Africa. However, we expect a shift in this allocation due to the improved economic outlook, particularly when contrasted with the political uncertainties faced in countries such as India and Mexico. Consequently, we could witness an uptick in valuations, as South Africa is currently trading at an atypical discount relative to Emerging Market peers.

Our strategy remains to be invested in high quality businesses with strong balance sheets and robust cash flow streams. With that in mind, valuations remain supportive, and we expect an improvement in earnings growth momentum over the next year, underpinned by favourable base effects, lower interest rates, and an improvement in economic activity as confidence improves.