Investing for income in times of turbulence

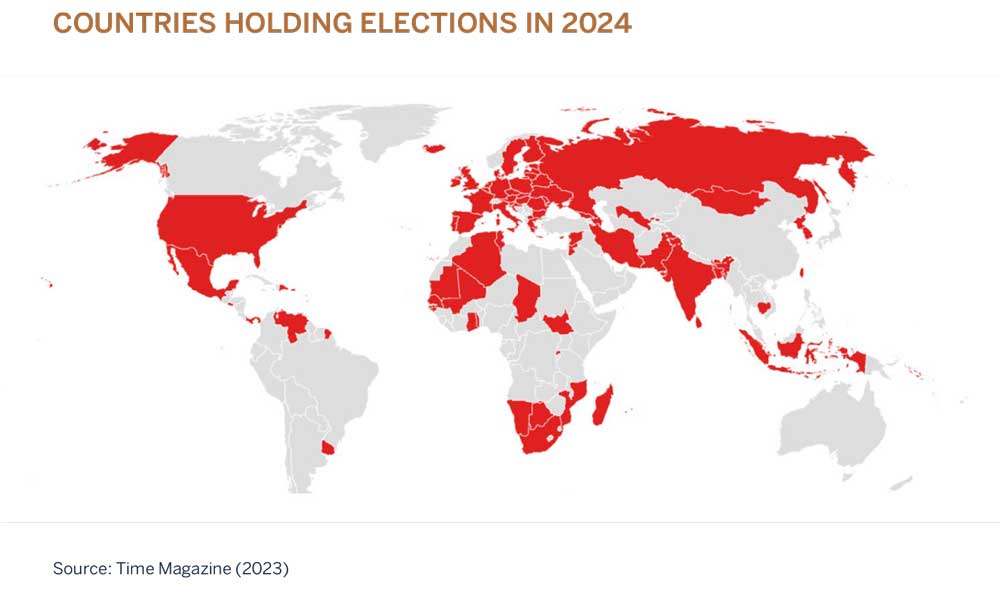

At the close of 2023, Time Magazine forecast that “more voters than ever in history will head to the polls” in 2024. Indeed, no fewer than 64 countries were scheduled to hold national elections this year. This, Time continued, represents a “combined population of about 49% of the people in the world”.

This poses many challenges and opportunities for investors. When nearly half of the world’s population faces potential political change in the course of a year, investors need to ensure that they are positioned accordingly. This takes on particular importance for those holding fixed income products.

How government bonds work

While elections impact most spheres of investment, fixed income investing is especially sensitive to changes in parliaments and presidents. This is because government bonds are the chief instruments for fixed income investment.

Governments issue bonds to raise capital. Investors buy these bonds for three reasons. First, the bond holder receives a regular yield. Second, these instruments can be traded with other investors. Finally, the government pays back the capital sum at the end of a defined period. That’s the simple part.

A change in political arrangements can signal important movements in bond markets. A new dispensation may have new fiscal policies and strategic imperatives, which can alter bond prices and yields.

What would you do if you held a bond from a country that you believed was no longer managing its fiscus as well as it was when you bought the bond? Typically, there are two responses. First, you may wish to sell the bond. When other investors share this sentiment, supply will rise and prices will fall.

Second, you may demand a higher yield in order to continue holding the bond. This is to compensate you for the additional perceived risk.

This mechanism operates in the opposite direction, too. If investors begin to believe a government will manage its money more wisely following an election, more buyers will be interested in holding or buying at any given price. This puts upward pressure on prices. Investors will also demand less compensation for risk, meaning yields experience downward pressure.

How do we measure a government’s management of the fiscus? Typically sovereign risk ratings provide the strongest indicator. If a government’s sovereign risk rating rises, this suggests prices may fall and yields will rise. Conversely, a lowering of sovereign risk signposts a rising bond price and lowering yields.

How does this impact investors?

Older investors tend to be impacted more acutely by bond market movements. Later in life, we typically hold more fixed income products because we seek lower risk portfolios and, once retired, we prefer investments that offer more predictable cash flows.

A changed fiscal environment can alter both the capital value and income element of an investment. As outlined above, the price of a bond and the yield are inversely related – they move in opposite directions.

South Africa: GNU and beyond

Having gone to the polls in May, South African investors are beginning to evaluate the new government of national unity (GNU) for its financial discipline. Broadly, the shifts in political power centres have been well received. Plans for greater private participation, increased oversight to rein in corruption, and the boon of vastly improved power supply have buoyed markets and attracted positive sentiment.

This informs our position of cautious optimism for SA Inc. As longterm investors, we view even large events, such as elections, as parts of a far greater whole. Client portfolios remain structured to individual needs, diversified across multiple asset types.

If you have any questions about fixed income and your investment strategy, please contact your portfolio manager.