From our Fund Manager’s Desk

Our quarterly reports regularly explore the investment rationale of one of the companies we own in the Fund to articulate what we find compelling. This time round we have chosen Visa. Have you been using notes and coins less often? Me too.

This trend has gathered pace with the introduction of contactless payment cards. Over the past few years the introduction of convenient (and often lower cost) tap-in payment for trains, buses and trams has nudged countless commuters into using their card or phone to pay for other items. The pandemic has further accelerated a permanent change in transaction behaviours over the course of months rather than years. Many retailers across the globe have stopped accepting “dirty” cash, which has been handled by thousands of other people. In many cases there will be no going back. The global lockdowns have also forced many more home-bound customers to become ecommerce aficionados. Most have been pleasantly surprised by the experience.

Unsurprisingly, global payments networks will flourish in a world in which the number of digital payment transactions are rapidly growing. Visa and MasterCard have by far the largest and most dominant networks in the world, resulting in a stable and lucrative duopoly. We own both in the fund. There are nuances and differences between the two, but the underlying thematic growth drivers are the same. For simplicity we elaborate further on Visa, but much of the story can be interchanged with MasterCard.

HOW DO THEY MAKE MONEY? A TINY TURN ON MANY TRANSACTIONS.

A misconception is that Visa and MasterCard are credit card businesses. Although their brands are emblazoned on credit cards, they do not profit from the interest charged on the card nor do they take any of the default risk that comes from lending money. Credit profits and risks are taken on by card issuers such as HSBC, BNP Paribas or JPMorgan. Rising consumer defaults during a global recession are not Visa’s problem.

Instead, Visa acts as the middleman connecting payers and payees through a vast network that has widespread acceptance and usage. It operates a four-party payment model, which includes Visa, the financial institution issuing the card (“issuer”), the business receiving the payment (“merchant”) and the merchant’s bank (“acquirer). Visa earns fees on the volume of payments made under its brand and through its network.

By enabling a transaction Visa collects a tiny sliver of a fee of about $0.03 to $0.05 on a typical $100.00 payment. The company processed $11 trillion worth of transactions last year. Minuscule numbers become very big numbers on such a large base. However, the small fee provides little incentive for a new entrant to spend the egregious cost of building out of a similar network and trusted brand from scratch to reach enough scale to make it a profitable enterprise. It took Visa decades and billions to get to where it is.

In fact, the company is the quintessential example of the network effect in action. Each additional cardholder makes the Visa brand more attractive for merchants to accept Visa payments. While each new merchant that accepts Visa makes the brand more attractive to cardholders.

HOW MUCH GROWTH IS LEFT? A LOT OVER MANY YEARS.

Visa’s management recently outlined its plans to grow its payments volumes by a staggering 10 times over the next two decades. Before one dismisses this seemingly outlandish ambition, it should be noted the company has already achieved this feat every 20 years or so. The first ten-bagger period was from the 1960s to 1970s, it then grew revenue by another 10 times from the 1970s to 1990s, and then another from the 1990s to 2010s.

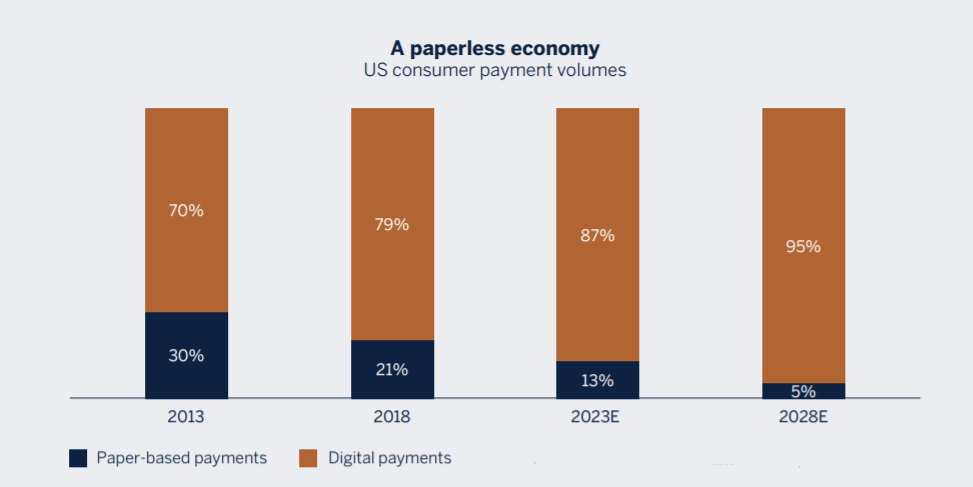

The company expects to continue to add new customers to the Visa network. But the big underlying driver is the increasing digitization of payments, driven by contactless card payment and ecommerce. As shown in the chart, digital (card and end-to-end electronic) have steadily gained share over paper payments (cash, cheques, travelers cheques and money orders). Digital payments have increased from 70% of all US transaction volumes in 2013 to 79% in 2018 and are expected to reach 95% by 2028. Cash is still the predominant means of exchange in many other parts of the world. Expect the transition to digital money to have many more years to run.

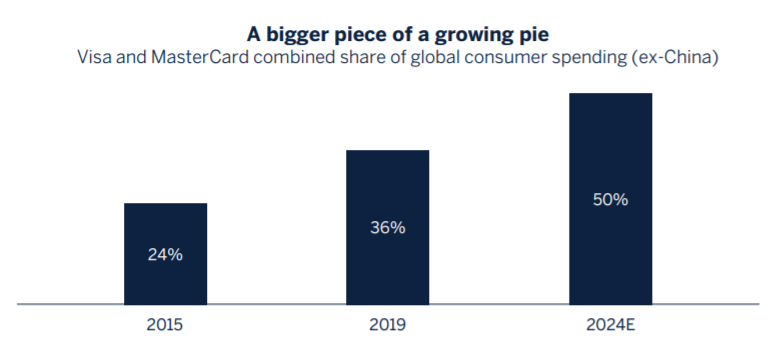

All this helps Visa and MasterCard to garner a bigger share of the wallet. As shown below, the two companies alone have approximately 35% to 40% combined share of global consumer expenditure (excluding China), from which the payments networks have about $100 billion revenue potential. If we extrapolate the share gains over the past four years (i.e. three percentage points a year) then both companies will increase their market share to around 50% by 2024.

WHAT ABOUT COMPETITION?

Not for want of trying, the big western internet companies have long tried to muscle in on the payments space. Their lack of meaningful success has been due to the stickiness of existing payment methods, challenges in changing merchant acceptance and the fact that existing payment experiences work well. These potential disruptors have largely become allies, or at least frenemies. PayPal caved in on steering consumers away from Visa and MasterCard by taking money directly from users’ bank accounts. Apple Pay and Google Pay are funded by cards. Fintech banks, such as Revolut and Monza in the UK, use Visa and MasterCard for payments. In most instances, big tech’s desire to “reinvent payments” has been a solution looking for a non-existent problem.

WHAT ABOUT CORONAVIRUS?

Near-term, social distancing restrictions have impacted some transactions, especially those involving travel. But Visa is a big winner over the long run. For example, the uptick in ecommerce has a disproportionate impact on Visa’s volumes. 15% of offline transactions go through Visa’s network whilst 43% of online transactions do. Therefore, every dollar of spending which shifts from offline to online has triple the impact on volumes across Visa’s network.

AND THERE IS MORE…

Beyond consumer payments, Visa believes it has just scratched the surface when it comes to new “non-shopping” sources of payment, money movement and value-added services. Its Visa Direct platform enables person-to-person, business-to-consumer and business-to-business payments. For example, the platform enables insurance claims to be paid to customers more easily or an internet gaming company to provide near-instant pay-outs for bet winnings. By capturing the movement of money between individuals, businesses and governments, Visa has a realistic opportunity of handling more of the $185 trillion flows across the globe that occur over the course of a year. Visa will only have a small proportion of this addressable market, but the opportunities are 10 times greater than those found in the consumer payments part of its business.

Visa is not short of ten-bagger growth opportunities over the next 20 years. This classic compounder remains a core holding in our client portfolios.