From our Fund Manager’s Desk

We regularly explore the investment rationale of one of the companies we own in the Fund, to articulate what we find compelling. This time round we have chosen Tencent. Founded in 1998 by Pony Ma, Tencent has grown from being a small internet company in China to becoming one of the top 10 most valuable companies in the world. The company’s sustainable growth over the years, combined with the protective moat it has built around its empire is what piqued our interest.

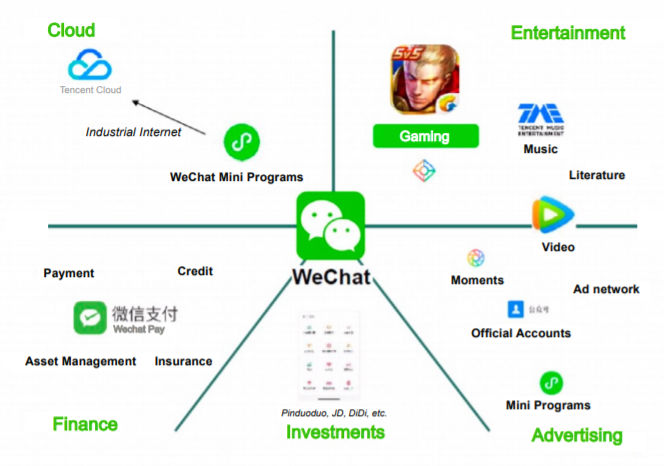

1.2 billion is a large number. It is the number of active users on WeChat, Tencent’s core platform that diverts traffic across a wide range of services from messaging, to entrainment, to payments, gaming and more recently, WeChat Enterprise and Cloud. From the onset, Tencent recognised the importance of user acquisition: instead of developing a product that would be sold to customers at a fee, the company looked to shore up as many users upfront by offering a free messaging and social networking service. The stickiness of its WeChat social media service has been key to its success as it has allowed Tencent to strengthen its core platform through the network effect – a situation in which a product or service becomes more valuable as more people use it.

By leveraging the network effect, Tencent captures more than 50% of Chinese users’ online time spent through its WeChat platform, making it indispensable in day-to-day life. WeChat combines several services under one roof – imagine having access to Facebook, WhatsApp, Spotify, Apple Pay, YouTube, Uber, Amazon and Deliveroo all bundled in a single app. That is the power of Tencent’s WeChat platform. WeChat users can message their friends and family, read the news, play games, share interesting images from their travels, shop online, order take-aways and make payments. With more than 45 billion messages being exchanged daily, Tencent benefits from having access to reams of consumer preferences and data. Hungry corporates have noticed the attractiveness of this sticky network base and the billions of eyeballs it attracts.

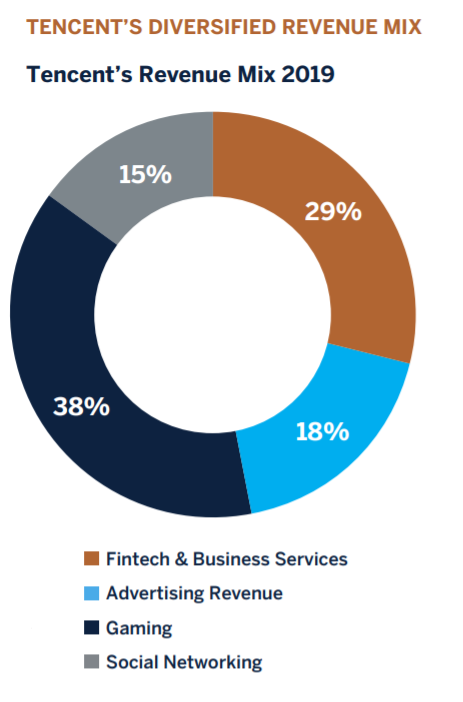

Communication and connectedness are integral to the Chinese consumer’s psyche. That is why many companies, both local and international, use official WeChat accounts to market, communicate and advertise their products to the highly attractive Chinese consumer base. This is a relatively low-cost method to promote brand awareness, connect with your customers and grow your followers. Despite the gold-mine that Tencent is sitting on, given the high traffic that passes through its platforms daily, the company only generates 18% of revenue from online advertising. This compares to Facebook – the world’s largest online advertising platform – that generates 98% of revenues from digital advertising.

Though Tencent could easily increase its advertising revenues from current levels, the company has actively chosen not to do so in the interest of promoting superior user experience – striking a fine balance between monetisation and quality user experience. After all, it is the users that are the foundation of this business model.

Outside of advertising, Tencent has a huge video gaming offering that commands the lion’s share of the Chinese market. Moreover, the company has made considerable progress in diversifying into the international gaming market - the recent consolidation of Supercell has allowed Tencent to gain access to five of the top 10 games worldwide in terms of daily active use. Though the outlook for gaming and advertising look strong, greater opportunities lie in the faster growing services such as cloud computing and payments. This will assist in tilting the business mix in favour of subscription revenues that will enhance the stability of the business model by improving the underlying earnings visibility, as in the case of the cloud business.

Innovation has been instrumental in shaping Tencent’s ecosystem to ensure it thrives and progresses inline with industry changes. The recent lifestyle changes placed upon us as a result of economies adapting to the threat of the COVID-19 crisis has further accelerated the adoption of new behavioural routines. WeChat Work is used by enterprises to facilitate remote communication not only internally with employees but also with customers. The app has the added benefit of integrating into other third-party apps such as customer relationship management, human resources and accounting systems to allow for an end-to-end wholistic user experience. This is highly beneficial to corporates who have had to ensure smooth transitioning in shifting workloads online. The company also flagged a boost in activity on their digital healthcare platform as millions of Chinese users made use of the video capabilities to reach out to doctors and healthcare professionals.

As the world’s largest gaming company, Tencent’s gaming business is expected to benefit from the consequences of social distancing, or rather physical distancing. Both new and existing users have been taking to video games as a way of connecting with people, while engaging in an interactive and social manner. Top grossing games like Honour of Kings, Players Unknown Battleground and Call of Duty Mobile are sure to keep us entertained during this period in insolation. People are innately social, and Tencent’s ecosystem is perfectly set-up to facilitate continuity of engagement levels despite the temporary physical barriers that are keeping us apart.

With diversified revenue streams, a sticky user base and attractive monetisation opportunities underpinned by structural growth levers, we see Tencent expanding and strengthening its moat. We back Tencent to constantly innovate and re-invent itself to ensure it remains essential in its users lives. On this basis, we view Tencent as a key holding in the Fund that is well positioned to deliver compounding shareholder returns over the long-term.