From our Fund Manager’s Desk

Shoprite

Shoprite is not your Average Supermarket company: Shoprite’s strong performance within Melville Douglas portfolios may tempt some to consider exiting, given the impressive returns generated over a relatively short period. However, we believe the group’s operational potential is far from fully realised. Management has already made significant strides, including the restructuring of its Rest of Africa operations by exiting unprofitable regions and returning the remaining regions to profitability. The next phase of growth lies in closing gaps in the high-income consumer market, where the group remains underrepresented, while continuing to capitalise on its broader ecosystem.

Multi-decade Long Success Story

Shoprite Group’s remarkable success story began in the late 1970s with the acquisition of a family-owned local grocer in the Western Cape. It is astounding how a business that was once valued at less than R1 million, with a vision primarily focused on serving the lower-to-middle income market, has now become a multi-billion Rand corporation. This growth has been driven by opening new stores and acquiring promising supermarkets or groups of supermarkets across South Africa and the rest of the African continent.

The beginning of the 1990’s heralds the group’s entry into the rest of the African continent, opening in Windhoek, Namibia. By then, the small 8-store Western Cape grocer had bought Ackermans Food Stores, the Grand Bazaars Group, now operating out of 71 stores, followed by the significant purchase of Checkers for R55 million, a hefty price tag by the group’s standards at that time. Management successfully turned around the loss-making Checkers Group, which comprised of 169 stores, saving 16,500 jobs.

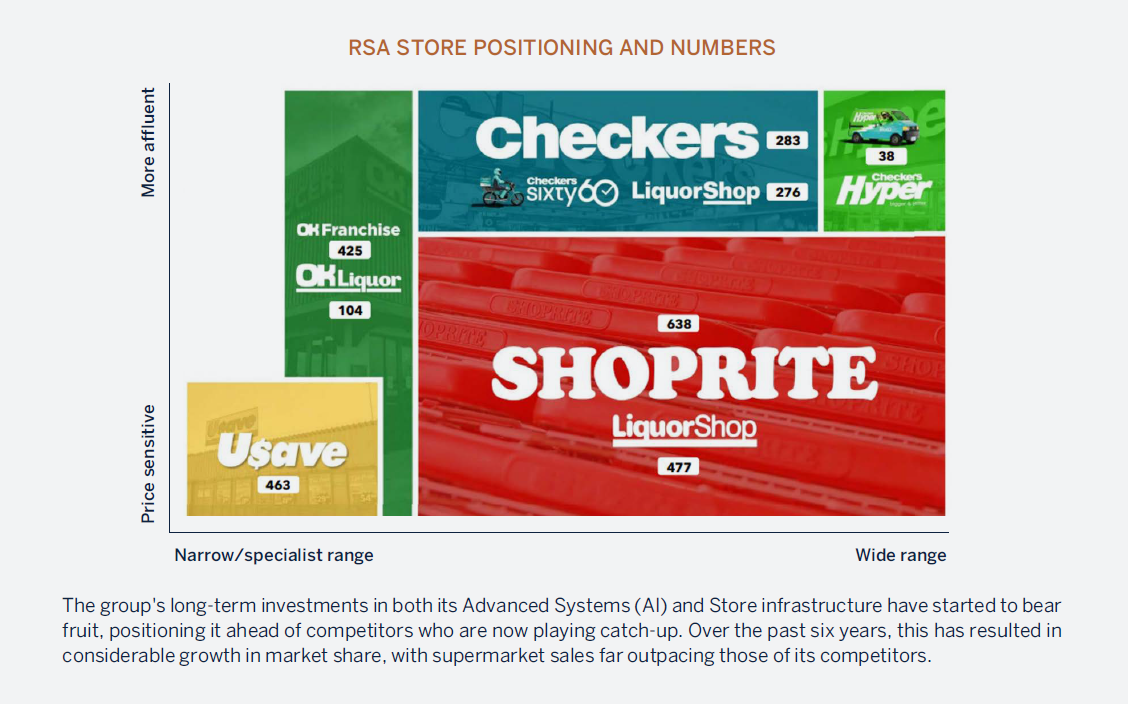

Diverse and distinct customer offering

The group’s diverse brand of supermarkets have a distinct objective, servicing customers across all income levels. Shoprite prides itself as Africa’s low-price supermarket; U$ave offers a limited assortment of products through its proximity-to-home stores; Checkers, the group’s omnichannel market leader, offers value in fresh, groceries and food to the upper income customer and Checkers Hypers, similar to Checkers, offers a wider product range.

The group’s diverse brand of supermarkets have a distinct objective, servicing customers across all income levels. Shoprite prides itself as Africa’s low-price supermarket; U$ave offers a limited assortment of products through its proximity-to-home stores; Checkers, the group’s omnichannel market leader, offers value in fresh, groceries and food to the upper income customer and Checkers Hypers, similar to Checkers, offers a wider product range.

Retail has largely evolved without significant disruptions, especially in South Africa, yet Shoprite Holdings has redefined the landscape in Africa. By adopting 'precision retailing' and introducing its forward-thinking ShopriteX brand alongside the award-winning Xtra Savings rewards programme, the group has positioned itself as a true disruptor in the industry.

The group’s advanced customer analytics business was brought in-house effective December 2023, which allows the group to have full ownership and control of the Intellectual Property behind ShopriteX. This platform has been instrumental in the success of the group’s future-fit digital channel, Sixty60.

Sixty60’s exceptional online momentum continues unabated.

Sixty60 seems to have defied all market sceptics, doubting that customers will continue using the platform postpandemic.

Instead, it has achieved record rate customer retention and advocacy despite increasing competition. Given management’s expressed intent to increase Checker’s smaller format stores and FreshX stores, the platform is set to continue its growth path. Since the launch of the platform in 2020, Sixty60 has created over 11,500 jobs and is now picking up from most of the existing stores.

Excessive levels of load-shedding couldn’t stop Sixty60.

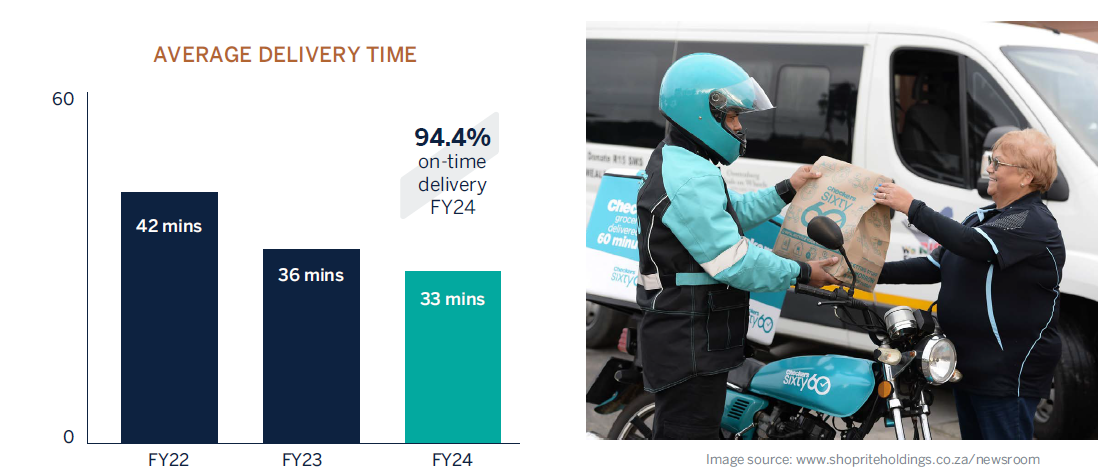

The concept of Sixty60 – “for customers’ to order groceries in sixty seconds and have them delivered in as little as sixty minutes”, seemed like an over ambition at first. However, the platform seems to be improving delivery times year on year, which is impressive given the increasing number of users.

Investing for growth through the cycle

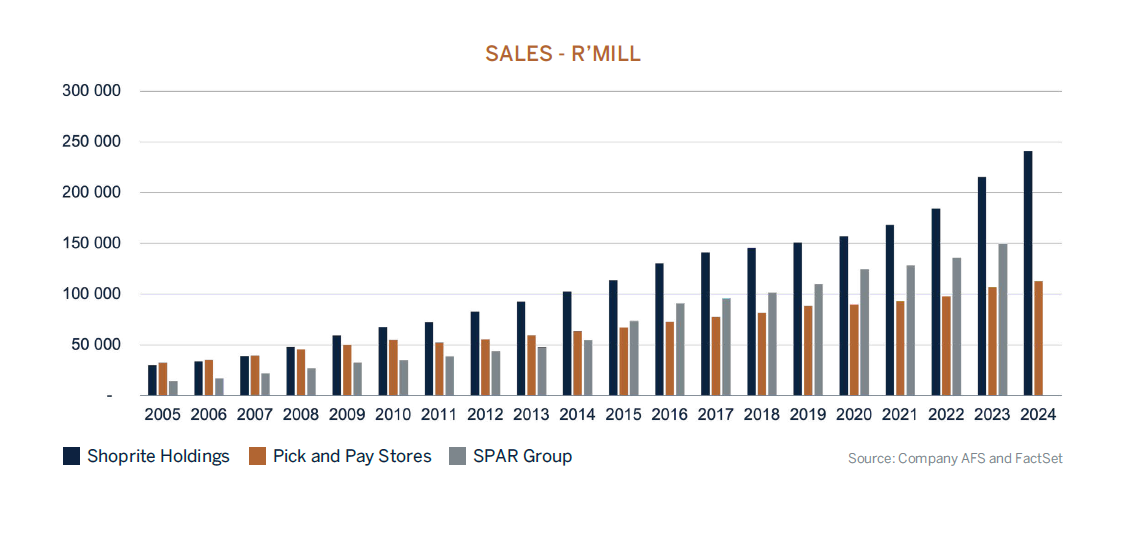

While some may view the group as "ex-growth," Shoprite's strong market share, commitment to digital transformation, and efforts to enhance customer engagement provide a solid foundation for resilience. By streamlining its supply chain through advanced analytics, Shoprite has meaningfully reduced costs and improved product availability.

Shoprite has consistently demonstrated strong financial health and growth, distinguishing itself as a standout performer in the market. Its ability to generate sustainable returns and compound growth over time sets it apart from many other companies. This consistent performance not only reflects the company’s strategic management and operational efficiency but also its resilience in navigating market challenges.

As the economy stabilises, the group is well-positioned to capitalise on renewed consumer confidence and spending. With competitors struggling to keep pace, Shoprite's advanced systems and infrastructure give it a significant competitive edge. If the broader economic environment continues to improve, the group’s ability to adapt and innovate could further enhance its prospects, leading to new opportunities for growth, especially as consumer behaviour shifts and demand evolves.

As investors, our confidence in Shoprite is bolstered by its proven ability to deliver value. Our investment strategy is not solely focused on short-term gains; we are committed to the long-term potential and stability that Shoprite consistently offers.