From our Fund Manager’s Desk

Reunert Limited

Our quarterly reports regularly explore the investment rationale of one of the companies we own in the Melville Douglas Equity funds and across client portfolios, to articulate what we find compelling. This time around we have chosen Reunert Limited.

Reunert has been a standout performer and has been largely disconnected from the challenging macroeconomic landscape in South Africa, driven by its exposure to rapidly growing areas such as renewable energy, defence, and information technology. In short, the growth trajectory remains on a steady footing, underpinning further outperformance.

Back in business and ready to grow

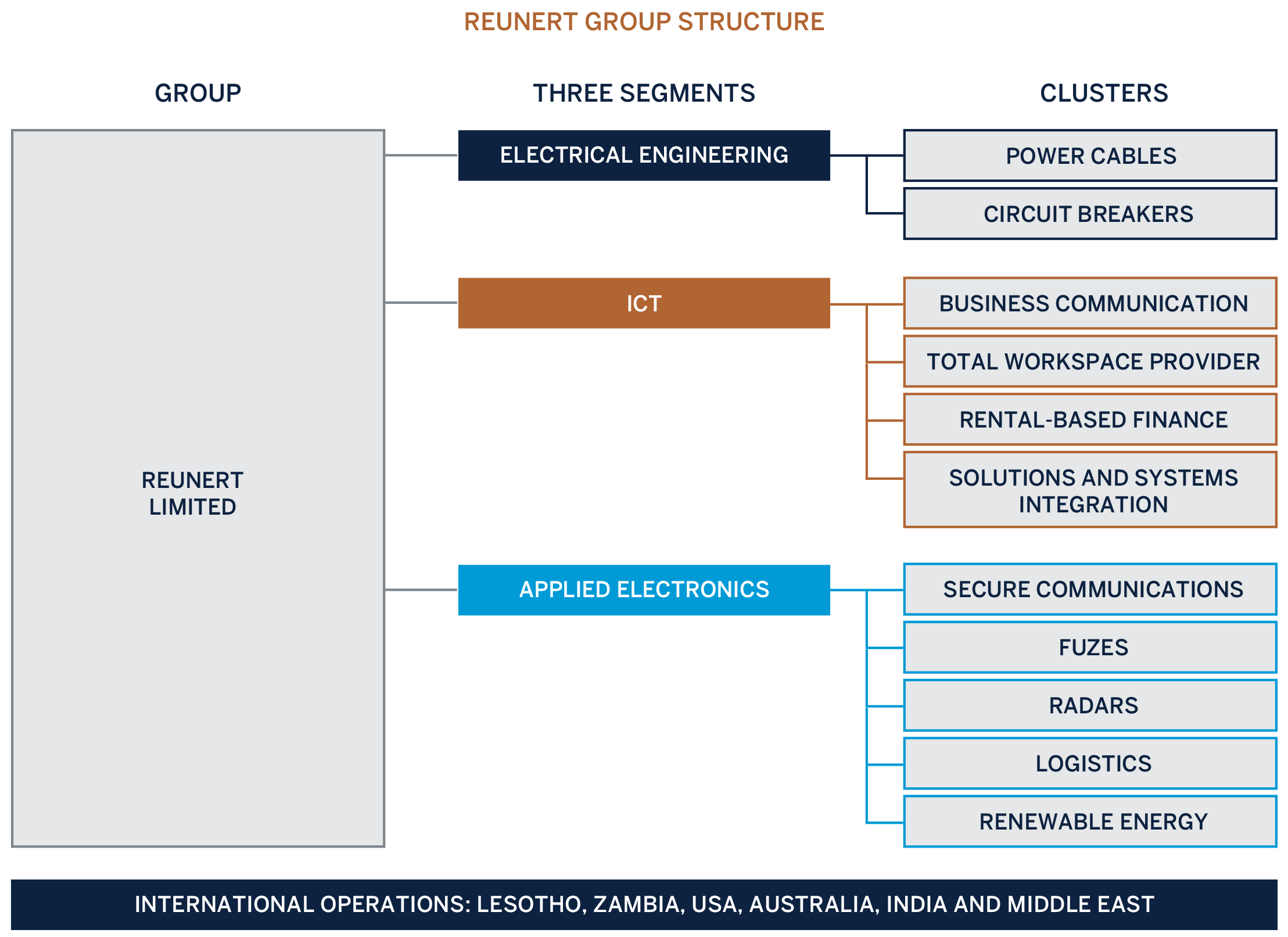

Reunert has a rich history (established in 1888) and has evolved over many years. It currently boasts high quality businesses operating across electrical engineering, IT and business support, defence, and electronics.

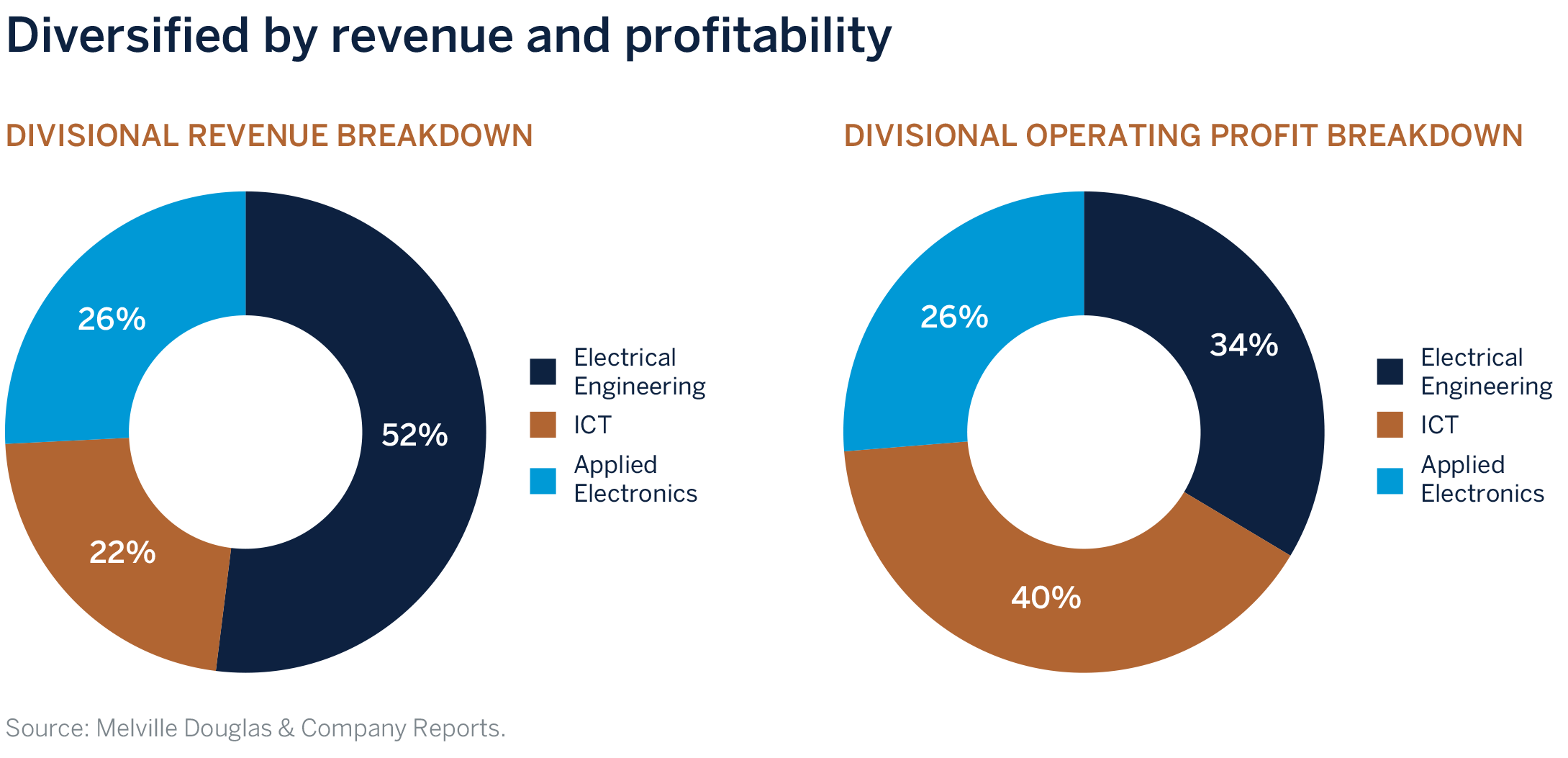

The group strategy is to achieve scale economics within growth businesses by adding adjacent new markets and through geographical expansion. The group generates 35% of revenue outside South Africa, 26% from the rest of Africa and 9% from developed markets. Reunert has successfully navigated South Africa’s challenges, such as loadshedding, logistical difficulties and, low economic growth. It has managed to coax a considerable amount of revenue out of its businesses that are not overly exposed to these issues.

This momentum is expected to continue, driven by the following:

Renewable energy opportunity

Reunert has developed into an end-to-end renewable energy business with an offering that spans across embedded generation, energy storage, cables, smart energy management and wheeling. Increasing cost of electricity and the reforms in the energy space should sustain the strong demand for renewables.

Investment in the private renewable energy sector is expected to continue to drive volume growth. The South African renewable market is forecast to build 1.8-2GW worth of solar energy per annum over the next 4-5 years.

Reunert is focused primarily in the commercial and industrial sectors (this accounts for 70% of installed rooftop solar). Furthermore, Reunert is also building its own plants, and currently owns 65MW of solar plants, and aspires to get to 400MW over the long-term. Reunert management indicated that it is currently seeing good orders in the large battery storage business. Large battery storage is also forecasted to grow between 25-35% per annum over the next seven years.

Expansion of the grid transmission

Inadequate transmission is an impediment to new renewable energy generation, and as such, transmission investments are critical in South Africa given poor investment in prior years. This looming expansion of the grid capacity presents opportunities for Reunert. Eskom has a significant capex plan (R300bn) to refurbish and expand its grid transmission over the next 10 years (anticipating 14,218km of new transmission lines vs. 4,000km over the past decade). This should provide Reunert’s Electrical Engineering business with additional incremental volume over the next decade.

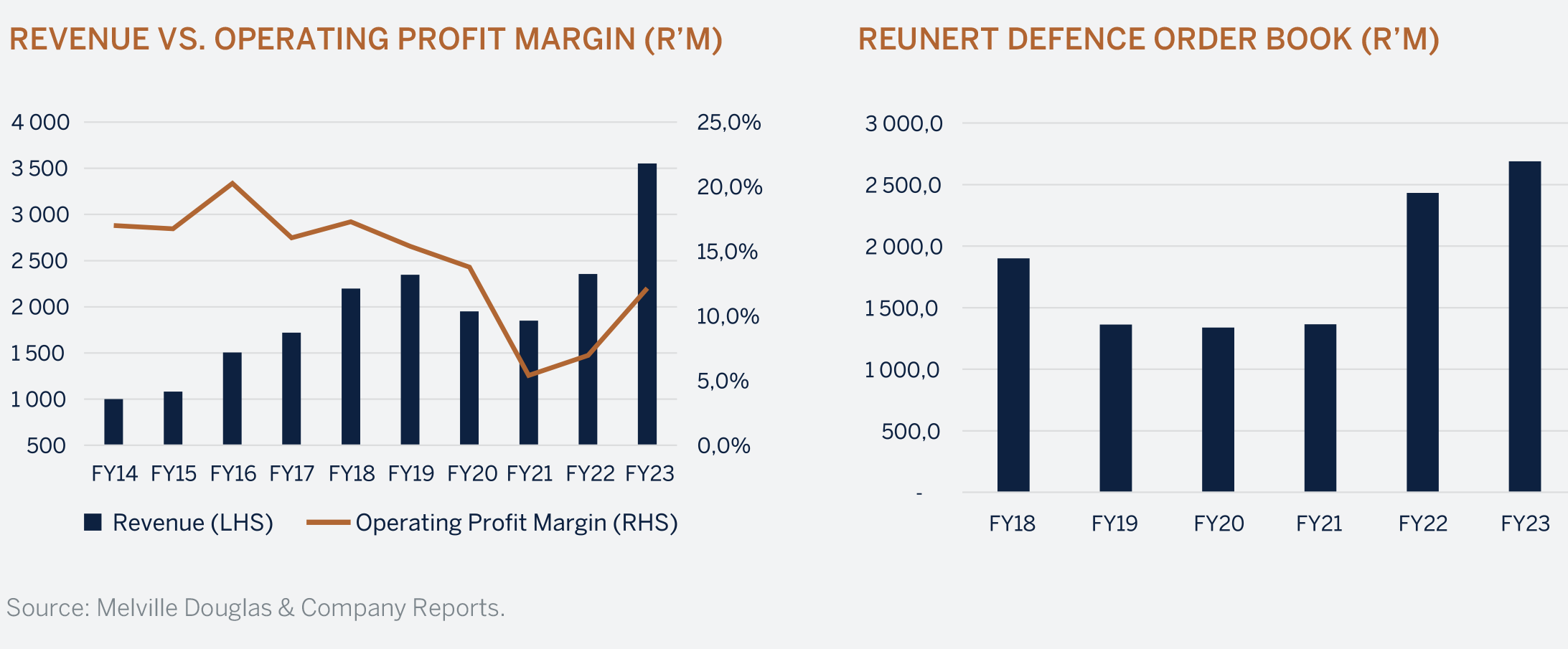

Ongoing political tensions driving the defence business

Reunert’s defence business has grown in leaps and bounds and should continue to grow amidst ongoing geopolitical tensions. Whilst it is impossible to predict an end to the current geopolitical tensions, Reunert is likely to continue receiving strong export orders. The Ukraine crisis has resulted in all NATO countries increasing their defence budgets as a percentage of GDP from an average of 1.1% to 2%, spurring demand for Reunert products. Inter alia, Reunert supplies electronic fuses for military application, radars, wireless detonation for mining applications, tactical secure defence communications, helmet tracker system electronics and tactical navigation systems.

Reunert’s defence order book remains strong and profit margins are in good shape, and this should position the business to continue to deliver growth in the near-to-medium term. We also note that profitability in the defence business is attractive. Historically margins were as high as 20% in fiscal year 2016, compared to the current 12%, recorded in fiscal year 2013. We believe there is room for margins to head back towards prior highs.

Evolution in the ICT division

The ICT business (previously known as Nashua) transitioned from a legacy print business to a total workspace provider, offering a broad range of services to augment the print business. Reunert’s ICT division now offers various services, i.e. software engineering, data & analytics, digital integration, and these expanded offerings are centered on enabling clients to win in the digital economy.

Essentially, Reunert has capabilities to design, build, deploy, and maintain custom software products for its clients, and importantly, it has both the tech talent, and industry know-how to give them a competitive advantage. The South African IT service market is projected to grow by 92% from R34bn in 2020 to R66bn in 2025.

Great growth story, with reasonable valuations

Reunert forms part of the growth exposure in the Melville Douglas portfolios. As outlined above, Reunert’s exposure to the defence, renewable energy and high voltage sectors are key drivers. The group’s balance sheet remains healthy, in a net cash position with strong conversion of accounting earnings into cash.

Despite increased disquiet about South Africa economic conditions, we are positive on Reunert and expect strong +14% per annum profit growth over the next three years. The stock also pays a sacrosanct dividend, which is expected to yield around 6% this year. We believe that this is a great growth story at a reasonable price.

Despite increased disquiet about South Africa economic conditions, we are positive on Reunert and expect strong earnings growth dynamics over the near to medium term. The business is in a cyclical upswing.