We regularly explore the investment rationale of one of the companies we own in the Melville Douglas Global Equity fund to articulate what we find compelling. This time round we have chosen Microsoft.

Remarkably, for a 46-year old tech company, Microsoft continues to thrive in an industry where longevity is akin to the mayfly-like career of a Premier League football manager. This note explains how the company has transitioned into one of the big winners of the cloud computing age. And why it deserves its place as one of the fund’s largest holdings.

Creative Destruction

The technology sector is centred around creative destruction, whereby innovation destroys what came before it. There are no sacred cows. IBM is a good example and the start of our story.

The old saying “nobody ever got fired for buying IBM” encapsulated the strength of its brand in the 1970s. Having dominated the market for room-sized mainframe computers, the company known as Big Blue fumbled the transition to personal computing. It launched its own PC in 1981 but outsourced the operating system to an upstart Microsoft. It did not take long for competitors to copy and commoditise IBM’s hardware. Microsoft supplied its operating system to not only IBM but also to its competitors. It became the industry standard and the rest is history.

During the 1980s and 1990s Microsoft established a lucrative monopoly centred on its proprietary Windows operating system and Office software (i.e. Word, Excel, Outlook, etc.). Try working in an office or home office without Microsoft’s software for a day, and you will have difficulty. But innovation has disrupted the way we use computing power in many other ways. And by the 2000s it was widely felt that Microsoft had missed multiple boats.

One missed opportunity has been its failure to capture more of the web applications market. For example, despite its dominant operating system, Microsoft’s Bing has only 7% market share in internet search compared to Google’s 87%. Another misstep was the smartphone market. The Windows Mobile smartphone operating system dismally flopped in its attempt to break the iPhone and Android duopoly.

Fortunately, it was third time lucky – cloud computing. There was a belief that Microsoft would never be a meaningful player in the cloud, and even a net loser. Despite entering the cloud computing market four years after the leader Amazon, it is best placed in the industry to garner a sizeable chunk of a massive pie.

What is the Cloud?

Apart from the weather, when people talk about the “cloud” they mean the internet. Cloud computing refers to software, data and services that can be accessed remotely on the internet, instead of being saved locally on your computer. Many cloud services are simply accessed through a web browser, such as Microsoft Explorer or Google Chrome. Consumer examples include Apple iCloud, Netflix, Dropbox and Microsoft OneDrive.

It makes a lot of sense for businesses to transition to a cloud computing model. The old “onpremise” model involves a substantial upfront outlay. This includes buying the hardware and software, and then hiring technicians to install and manage the system. By contrast a cloud model is more flexible, scalable and secure at a lower cost.

It is lower cost because there is no overspend on capacity and there are efficiencies in outsourcing to experts with scale. The traditional way of planning for unexpected growth is to purchase and keep additional servers, storage and software licenses. It may take years to use the reserve resources. By contrast, cloud computing services charge based on the features, storage, number of users, time and memory space among other factors. If you need more capacity or additional features your cloud provider will simply upgrade your package within minutes. Whereas on-premise new software implementations take months or even years for the in-house IT department to rollout.

The pandemic has highlighted mobility and security as a major benefit of cloud computing. The service enables employees to work from any location, such as from home or whilst travelling. Last year demonstrated the benefit of cloud computing services as backup storage, a better way for employees to collaborate on projects, a more secure way to store data and a plan for disaster recovery.

How Big is the Cloud Market Opportunity?

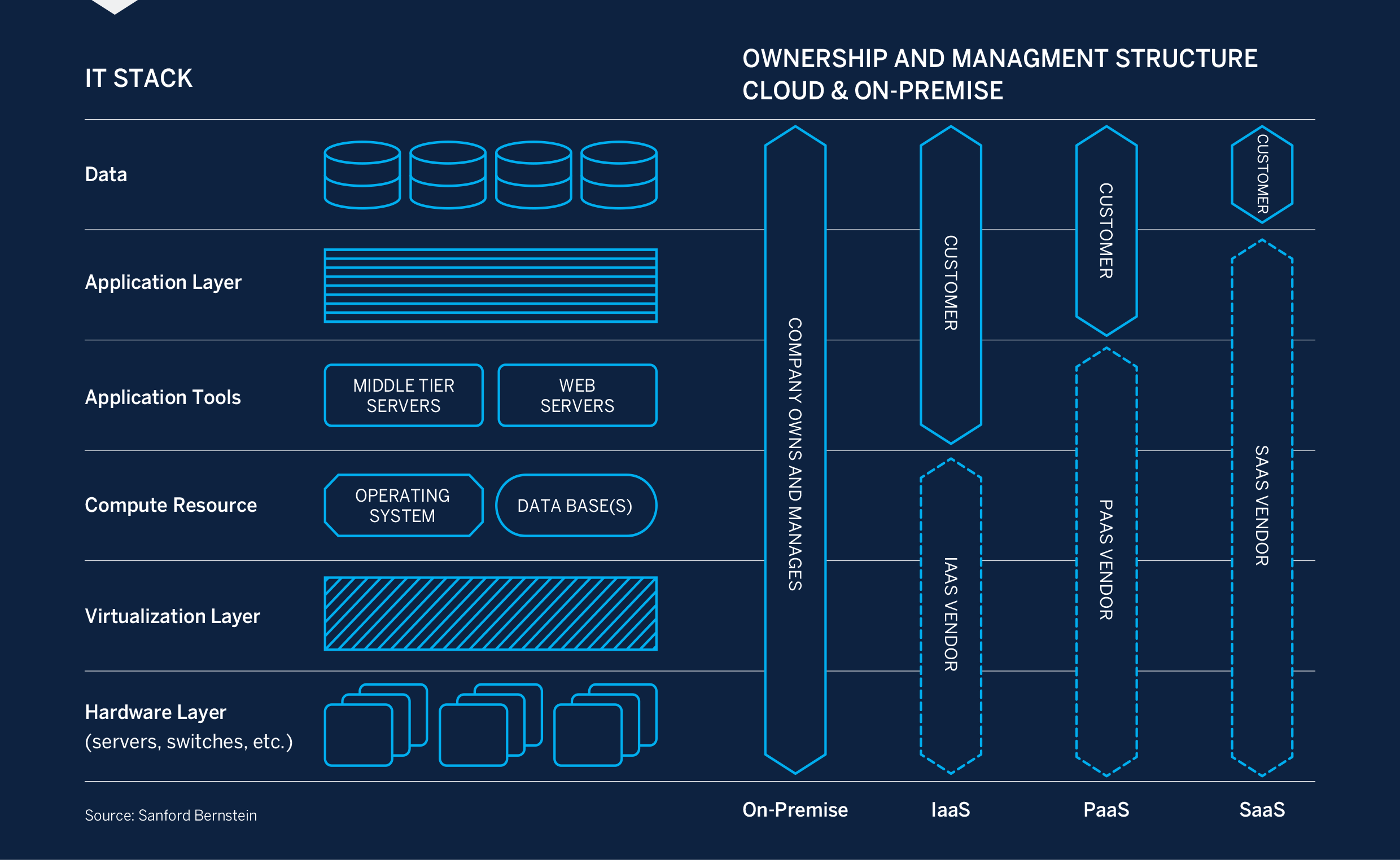

Cloud computing services are usually categorised into three main components: infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). When they are combined it is called a “stack” because each service is built on top of one another.

IaaS is the most basic category. With IaaS you rent IT infrastructure (i.e. servers, storage, networking and the necessary operating systems) from a cloud provider on a subscription basis. Amazon, Microsoft and Google are the top three global players in IaaS. In China, Alibaba and Tencent are the market leaders. As it is a commoditised service it is the lowest margin of the three cloud service categories. Economies of scale is the competitive advantage.

The next level up is PaaS. Essentially you are also renting the platform software sitting on top of IaaS. It provides an ondemand environment for developing, testing, delivering and managing software applications. PaaS allows developers to quickly create web or mobile applications without needing to set up the underlying IT infrastructure.

The most profitable part of the cloud is SaaS. The customer is only responsible for their data and the SaaS provider supplies everything else, including applications. In a nutshell the application software sitting on top of PaaS is being rented. The exciting aspect for Microsoft is that it has the biggest footprint across this stack through its cloud computing service and its Office and Dynamics products (more on this a little later). As such it can capture much of a customer’s hardware and software budget as well as their external and internal IT services expenditure.

According to TSO Logic (owned by Amazon), migrating from on-premise to the cloud can reduce a company’s IT infrastructure costs by 36% on average. However, Microsoft revenue is not just derived from garnering a slice of these savings, but also by capturing software sales from other vendors that do not provide a bundled service.

Furthermore, once a company has chosen a cloud provider and has lots of its business on its cloud it tends to stay with it. This makes cloud revenues sticky and reliable. Estimates of the amount of IT spending that could shift to the cloud varies depending on which person you speak to and how they define its scope. Sanford Bernstein estimates sales of around $2 trillion per annum based on IT spending on software, services, hardware and data centres in 2019.

This estimate refers to a maximum calculated size and not how large the cloud market will be in the foreseeable future. The main limiting factor is that some work will need to stay on-premise due to legal, regulatory, business and security reasons. Nonetheless, despite two decades of existence, cloud adoption is still in the early stages with lots of runway remaining.

Into Revenue And Profits?

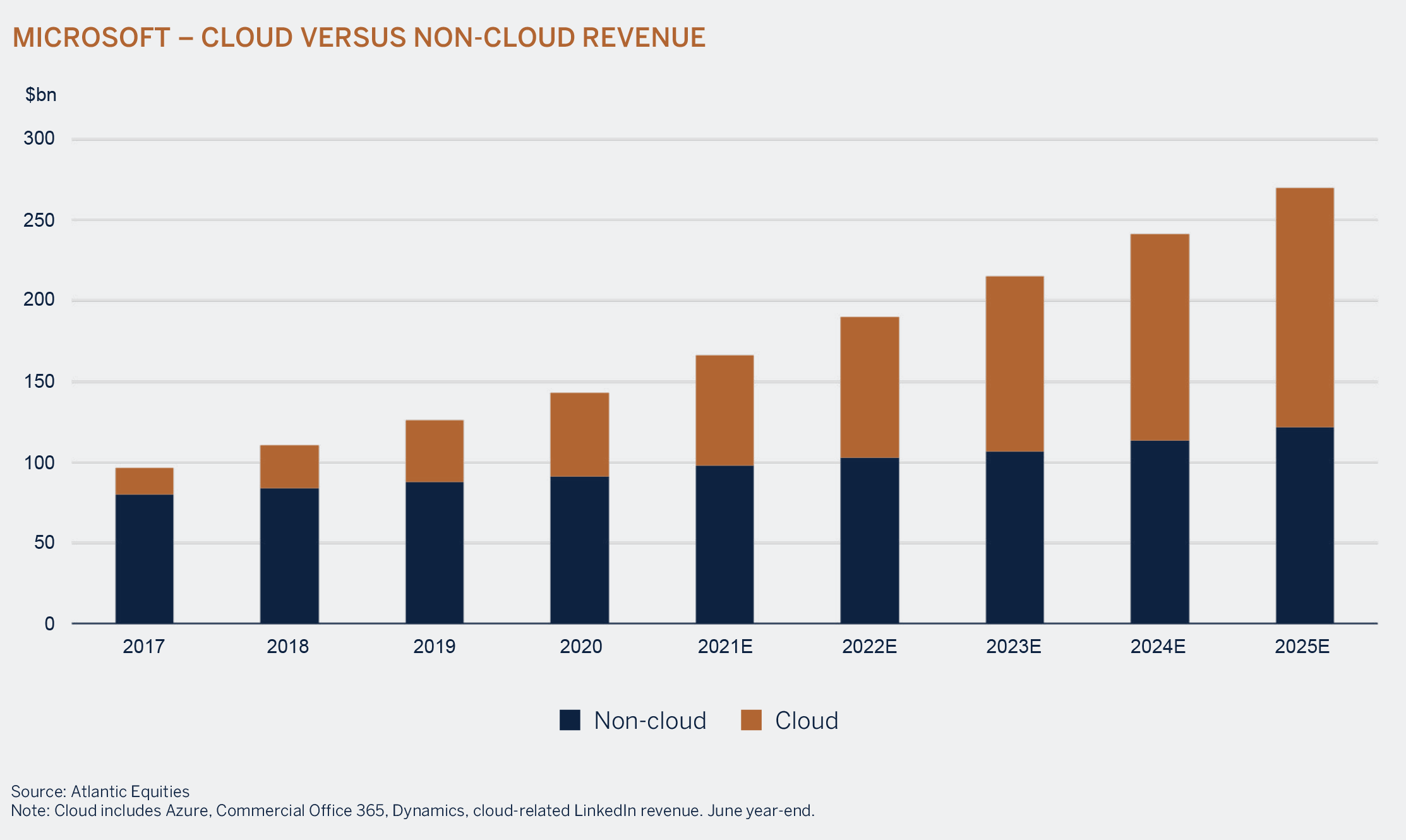

We expect Microsoft to almost double its group sales by 2025, driven by +20% annual growth of its cloud-centred businesses. Last year these businesses were about one third of total sales. They are expected to be more than half by 2025.

Microsoft Has Plenty of Other Irons in the Fire

First, it is performing well against other major cloud service providers, and has been gaining market share. A notable win was in 2019 when Microsoft secured a cloud contract with the US Department of Defense to provide services to the Pentagon, beating Amazon for the $10 billion deal. The top three players in descending order are Amazon, Microsoft and Google. Through their larger scale the big three offer customers lower costs and a better overall experience than the also-rans.

Second, Microsoft’s Dynamics has become a significant profit driver. This software service helps companies manage their finances, strategy, customer relationships and supply chains. It also owns LinkedIn, which is the world’s largest professional network that helps organisations hire talent and individuals to grow their personal career and contacts. The business makes money from job advertisers and news feed adverts, both of which have been seeing rapid growth.

Third, is its long running strength in office productivity. As mentioned earlier its Microsoft Office 365 software subscription suite, a tenth of current sales, enjoys a virtual monopoly in office productivity (i.e. Word, Excel, Outlook, Teams, etc) with nearly 90% market share and a wide competitive moat. It continues to improve the value of its offerings. Its basic “E3” Office package sells for $20 per seat per month. The cost of assembling best of breed single point solutions to yield the same functionality is estimated at $50 to $60 per month. For its highest priced package “E5” the cost is $35 compared to around $100 for a DIY version. The increased use of Teams (its unified communications platform) and demand for security during lockdowns is growing uptake of E5, which is a powerful driver of revenue and profit. The E5 version of Teams includes advanced features such as audio conferencing that can accommodate up to 250 people and a phone system that can replace expensive and complicated on-premise equipment. Given security products are usually taken as add-on products, Microsoft can gain share and disrupt the industry by offering security products which work with the cloud.

Fourth, is its gaming business. Its Xbox is the most popular game console in the US. Sales surged last year as a result of COVID-related stay-at-home restrictions. Beyond the pandemic, Xbox and Sony’s PlayStation are expected to continue to dominate the market as scale begets scale given there are powerful network effects associated with the social aspects of modern gaming. Importantly, Microsoft is a cash generation machine. It has a fantastic track record of translating around a quarter of its revenues into free cash flow over the past five years. This is cash available to distribute to shareholders or reinvest in new growth opportunities to create more wealth for shareholders. Given most of its businesses are becoming more subscription-based, a more robust, recurring and predictable business model should command a higher stock market valuation.

How Does This All Translate What Could Go Wrong?

Tech companies are like the Red Queen in Lewis Carroll’s “Through the Looking Glass”. They are constantly running to stay in the same place. Microsoft could trip up. It has a host of big and small competitors that are a who’s who of the technology sector. Amazon, Google, Oracle, salesforce.com, SAP, Slack and even its old foe IBM are among them.

Fortunately, it is not necessarily a zero sum game as the cloud opportunity is big enough for multiple winners. However, complacency is a recipe for obsolescence. So, we watch developments.

An often-cited risk for Big Tech investors is regulation, particularly in light of recent antitrust cases and legislation. Microsoft is not currently under the same level of scrutiny as Alphabet (Google’s parent company), Amazon, Apple and Facebook. The healthy competition within cloud computing and lower consumer-focus has meant Microsoft has not had the same level of scrutiny as its other big tech peers.

While the cloud transition continues to march on, accelerated by the impact of COVID-19 and work from home, one or more large cybersecurity breaches of major cloud providers could negatively affect the transition. Cloud is perceived as just as safe or safer than on-premise. So, a major breach could knock confidence.

Cloud Nine

Microsoft has successfully transitioned from a yesterday’s story to a big winner. As a result, it has reinforced its entrenched competitive advantages, a lucrative recurring revenue model and huge addressable market opportunities. Our investment philosophy is all about capturing compound returns by owning stakes in companies that can consistently deliver high returns on their shareholders’ investment capital, reinvest and repeat. Microsoft has been a textbook example.