From our Fund Manager’s Desk

Our quarterly reports regularly explore the investment rationale of one of the companies we own in the Fund to articulate what we find compelling. This time round we have chosen HDFC Bank.

Oil, agriculture or mining companies spring to mind when asked to name a commodity business. But banks, particularly their lending activities, should be at the top of the list.

Banks “sell” money, which is interchangeable with any other genuine physical or digital version of it. A mining company might gain an advantage by developing a much lower cost, higher-grade resource than its competitors. But big banks access the money they lend in the same way, which is to borrow from their depositors or from institutional lenders. In most developed economies, there is limited cost advantage when a bank gets to a certain size.

In addition, products and services are largely undifferentiated, regulatory burdens act as a constraint on growth and there are a multitude of players vying for a piece of the action. It is difficult to convince customers to pay extra for a brand-name mortgage or accept half the going rate on a savings account. Another niggle is that business and interest cycles lead to wild swings in bad debts and net interest margins (the difference between a bank’s borrowing and lending rates) that can swamp their steadier fee and commissions-based income. Unsurprisingly, there are few compelling opportunities within the banking sector for long-term investors.

But there are some. A well-run bank in a fast-growing economy with ineffectual competitors can generate persistently high levels of profitability and investment returns for its shareholders. HDFC Bank is one such opportunity.

WHAT IS HDFC BANK?

The name is not familiar outside India as it has stuck to its knitting by focusing on the domestic opportunities. HDFC Bank is India’s largest privately-owned bank. It was founded in 1994 as the banking offshoot of a mortgage company called Housing Development Finance Corporation.

It is a traditional bank. 70% of revenue comes from lending to individuals and businesses and 30% from charging its customers fees for various products and services. What is less traditional is its consistent long-term track record of rapid growth without taking undue risk.

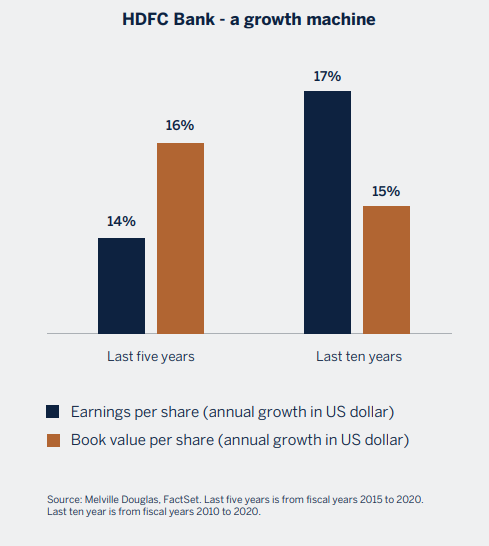

HDFC Bank’s book value and earning per share have grown +15% and +17% per annum respectively over the past ten years. There has been no meaningful slowdown off a higher base. The growth rate is at a similar rate over five years compared to over a decade. Impressively, HDFC Bank’s earnings per share did not drop in the fiscal year ending March 2009 (the worst period of the global financial crisis). A similar feat is predicted for the fiscal year ending 2021 (the worst of the pandemic).

This growth was driven by a combination of factors that we expect to continue for the foreseeable future:

/ The Indian economy

/ Expanding its footprint to an underbanked and growing population

/ Taking share from structurally weak competitors

Let’s take each in turn.

WHAT’S COMPELLING ABOUT THE INDIAN ECONOMY?

IT IS SCALE AND RAPID GROWTH.

The United Nations expects the population of India to overtake China by 2027. This does not mean India’s economy will be bigger by then. China’s economy is currently five times the size and it is different in many ways. A democratically elected Indian government could not direct the economy the way China does. Culturally, China is unified around the Han ethnic group which makes up 92% of the population. This contrasts with India’s linguistic and cultural diversity. Furthermore, India’s economy at this stage of its development is more likely to be driven by domestic consumption rather than be export-led.

What India has in its favour is a working population growing faster than dependents for the next three decades, urbanisation of the world’s largest rural population, a long entrepreneurial tradition and an expanding consumer class. There is plenty of scope for productivity improvements as a result of investments in infrastructure and education. If the economy were to continue to grow at its +6% to +7% per annum potential over the next two decades, it would be transformational for the country and a huge opportunity for companies able to tap into it.

THE UNDERBANKED OPPORTUNITY

A vast swath of the Indian population, including small businesses, are underbanked.

Being underbanked does not necessarily mean not having a bank account. Over 80% of Indian people have a bank account compared to 53% in 2014. This jump in banking penetration was a result of Prime Minister Narendra Modi’s flagship Jan Dhan programme (meaning “people’s wealth”). The scheme was launched in 2014 to provide no[1]frills bank accounts to economically weaker sections of society. Together with the rollout of Aadhaar, the world’s largest biometric identity programme, and high mobile phone penetration, the government claims greater financial inclusion through JAM (Jan Dhan-Aadhaar-Mobile). For example, JAM has enabled social security payments directly into people’s accounts.

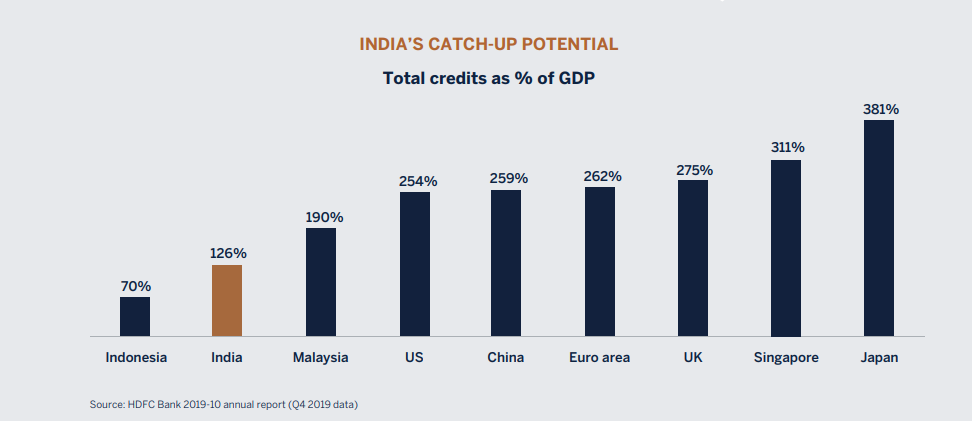

The problem is that, according to the World Bank, half of India’s bank accounts are inactive. This is double the rate of other developing countries. Low financial literacy levels mean that many people are unaware of the potential benefits they could reap from a bank account. As a result, access to credit and banking services in India is very much in its early days. As shown in the chart, India’s credit-to GDP ratio is well below other major nations. Closing this gap is a tailwind to go along with the expanding working age population and rising disposable income.

HDFC is tapping this potential by methodically building a bank branch footprint in the rural parts of India, where the banking penetration is the worst. Nearly half its 5,400 branches are in rural areas, making it by far India’s largest private network.

TAKING MARKET SHARE

Being in India is no guarantee of success. The Indian bank sector has a poor reputation with decrepit state-owned lenders and dubiously managed private-owned banks.

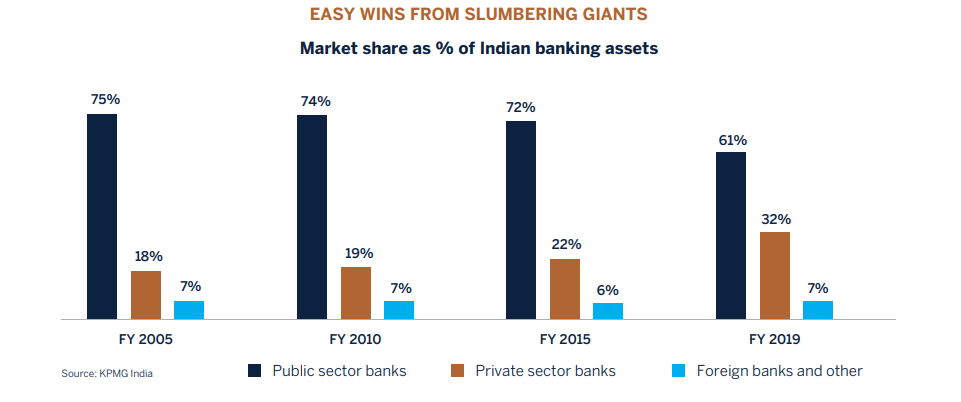

State run banks are not well managed and barely accountable. Their lending has tended to be politically motivated, they have sizeable non-performing loans and they tend to chase the same bad bets. The India banking sector was exclusively comprised of stated owned banks until the mid-1990s when the government allowed privately owned banks to compete in the hope they would operate without the corruption and inefficiency that had held back the economy. HDFC was among one of the first of these new entrants to be awarded a banking license.

This represented an opportunity for a well-run bank with a clean balance sheet to come in and cherry pick the best businesses. As a result of being managed by Indians with experience of working in big global banks such as Citibank, HDFC has always been ahead of the game on customer experience and operational management. The same cannot be said of other private banks sector, encapsulated by recent resignations of the bosses of Axis Bank, Yes Bank and ICICI due to governance or credit problems.

Over the past two decades HDFC Bank’s market share has increased from less than 1% to 8% of India’s banking assets. State owned banks share of banking assets has steadily declined from 74% in 2010 to about 61% in 2019 as private sector banks have taken share. We expect this to trend to continue over many years given the state-owned banks have plenty of share to lose.

WHERE’S THE MOAT?

HDFC Bank’s competitive advantage comes from being more efficient than the large state-owned banks. It lends at market rates yet has funding costs and expense ratios well below its competitors. That means the bank generates a high return on equity and reinvests most of its profits back into expanding market share.

The bank has stuck to its strategy of lending to Indian consumers and firms, using sophisticated processes adopted from foreign banks. As mentioned earlier, this strategy has resulted in a large branch network, half of which are outside cities. The bank has stayed away from foreign ventures and investment projects, avoided lending to India’s indebted oligarchs and has financed its balance-sheet through deposits rather than debt. This proved prescient. Other banks chased a credit boom in 2004 to 2007 which led to huge bad debts. HDFC largely avoided the fallout. Having an anchor shareholder in the form of Housing Development Finance Corporation helps to take the long-term view.

Cost advantage is an important source of competitive advantage for banks. The quality of management plays a big role in this, ensuring operating costs are below its peers, underwriting is more effective and borrowing costs are kept low (e.g. having an extensive branch presence to gather deposits).

Another competitive edge is superior customer experience and service. For example, the bank was the first bank in India to launch internet banking and mobile banking services in the late 1990s and early 2000s. Today, customer-initiated transactions in HDFC through mobile and internet channels are 92% of all transactions, up from around 30% in 2009. This results in high levels of convenience and usability for its customers.

GROWTH, BUT NOT AT ANY COST

Reassuringly the bank has managed to grow at a very rapid rate whilst taking a conservative approach on its balance sheet and without compromising on asset quality. Its total shareholders’ equity relative to total assets has been above 10% for over five years and currently stands at 11.7%. A higher number indicates less leverage. To put this in context, HDFC is more conservatively placed than its major Indian peers and big global banks such as JP Morgan and HSBC. As well as not overegging its leverage, the bank has kept bad debts in check. Its non-performing loans ratio since 2002 has never been above 2%. Non-performing loans as a proportion of overall loans are streets apart from private and public banking peers. HDFC Bank’s gross non-performing assets were 1.3% of total assets for the financial year to March 2019, compared with 2.3% for Kotak Mahindra and 6% for ICICI, India’s other big privately-owned banks.

WHAT ABOUT FINTECH COMPETITION?

New technologies are changing the way consumers deal with their finances and risk making obsolete the legacy systems at traditional banks. Developing countries, such as India, have the greatest opportunity for fintech firms given enormous unbanked and underbanked populations that have yet to be reached but who are already digitally connected.

HDFC is not a technology pioneer, but it is a fast follower. The bank claims to be in constant dialogue with 70-80 start[1]ups at any point of time in order to explore new solutions, including blockchain and artificial intelligence. HDFC’s key advantage lies in its hold on customer relationship. It is moving fast enough to ensure customers are getting a good experience through a low cost and convenient service. This makes it more difficult for disruptors to take market share. For example, the bank has invested heavily to automate its approval processes and keep costs low. As a result, an individual can initiate a loan approval through their mobile or internet channel, and get it approved in under 10 seconds.

So far so good for HDFC, but we will closely watch industry developments in these fast-changing times.

A PROVEN COMPOUNDER

HDFC Bank has translated its competence in bread-and[1]butter Indian banking amidst a sea of mediocrity into substantial value for its shareholders. Its New York stock exchange listed shares are up +22% per annum since their debut in 2001. These returns are backed by its rapidly growing profits that have been remarkably stable despite all the ups and downs in the Indian economy over the past two decades. The bank represents a compelling emerging market opportunity over the next decades and provides an attractive counterpoint in the portfolio.