From our Fund Manager’s Desk

Our quarterly reports regularly explore the investment rationale of one of the companies we own in the Fund to articulate what we find compelling. This time round we have chosen Brenntag.Better known as “cutting out the middleman”, disintermediation has reshaped the way suppliers of products and services interact with buyers. Technology-led disruption of traditional intermediary business models has made travel agents, insurance brokers and department stores less relevant. But not all industries are at risk. Brenntag is a case in point.

Founded in Berlin in 1874, Brenntag is the world’s leader in chemical distribution, connecting thousands of chemical producers and customers across the globe through a portfolio of more than 10,000 products. In essence it buys in bulk and then makes a turn on selling and distributing smaller quantities to the end-user.

Chemical distribution involves dealing with hazardous materials in a highly regulated industry that requires deep knowledge around products and its application. This complexity, entwined with Brenntag’s dense network of transportation routes and access to global supply, builds high barriers to entry that protect profits from being competed away.

Chemical producers admire scale but loathe complexity. Brenntag’s global scale enables the likes of Bayer and Dow to reach a wide range of customers in a cost-efficient manner. For customers, the convenience of dealing with a single distributor with a broad product offering simplifies the ordering process, as does outsourcing their own formulation and blending.

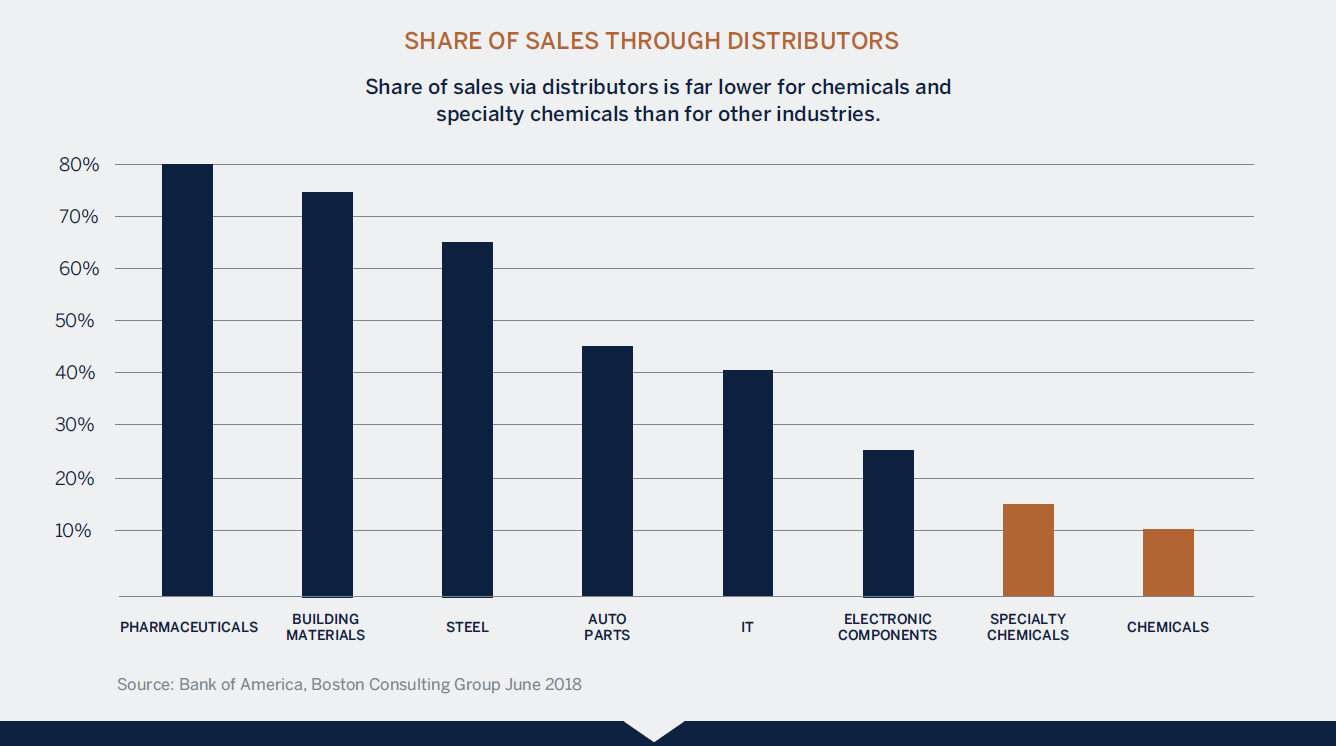

As shown below in the chart from Bank of America, less than 20% of the industry’s sales are serviced through third-party distributors. This is much lower than in other industries, providing ample runway for chemical distributors to grow share as chemical producers seek to save costs while maximizing sales.

Adversity makes you stronger

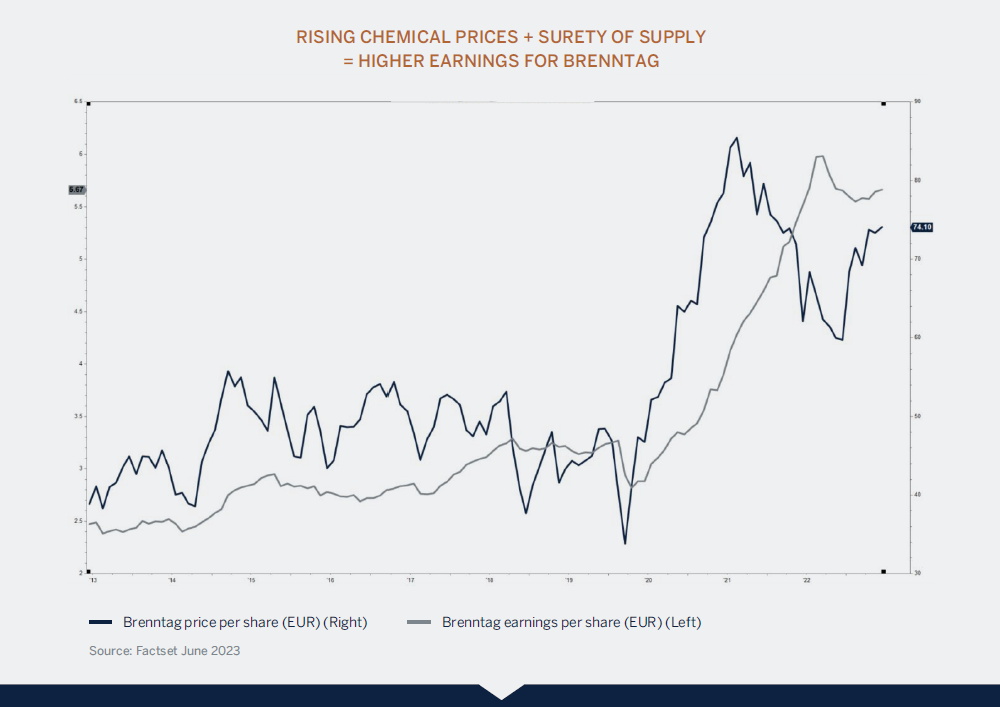

The pandemic related supply chain challenges that wreaked havoc for most companies were a blessing in disguise for Brenntag. Their broad, multi-source access to inventory across the globe combined with their extensive distribution network provided surety of supply. Brenntag’s customers – spanning a wide range of end industries – are willing to pay a premium for the flexibility, reliability, and quality of supply. The ability to purchase in smaller sizes (the average order size is EUR4,000) with shorter lead times helps with demand forecasting and cash flow management, a highly valued proposition regardless of the times.

The higher oil price – a key determinant of chemical prices – coupled with lockdown related supply shortages led to surging chemical prices during 2021 and 2022. Smaller distributors came under pressure as rising costs impaired their ability to compete effectively. Rising prices, surety of supply and limited competition elevated Brenntag’s importance in the value chain, and with it, their pricing power. This – in combination with a solid demand environment - resulted in bumper profits for the company in 2021 and 2022.

Not standing still

Brenntag has recently embarked on a multi-stage transformation program aimed at accelerating existing growth and capturing new opportunities. Part of the scope involves placing greater emphasis on its more profitable specialty chemicals division. This is expected to unlock significant value for investors. The specialties division grows at a faster rate to the bulkier, commoditized chemicals. Brenntag adds value to its clients through technical expertise on aspects such as product innovation to enhance performance, or new product formulations driven by a growing demand for sustainable ingredients. Through this expertise led consultative process, Brenntag’s specialties division is able to deliver higher profit margins as they develop specific applications that require customized formulations. Often, contracts are exclusive between the supplier and the distributor, protecting profit pools for both parties involved.

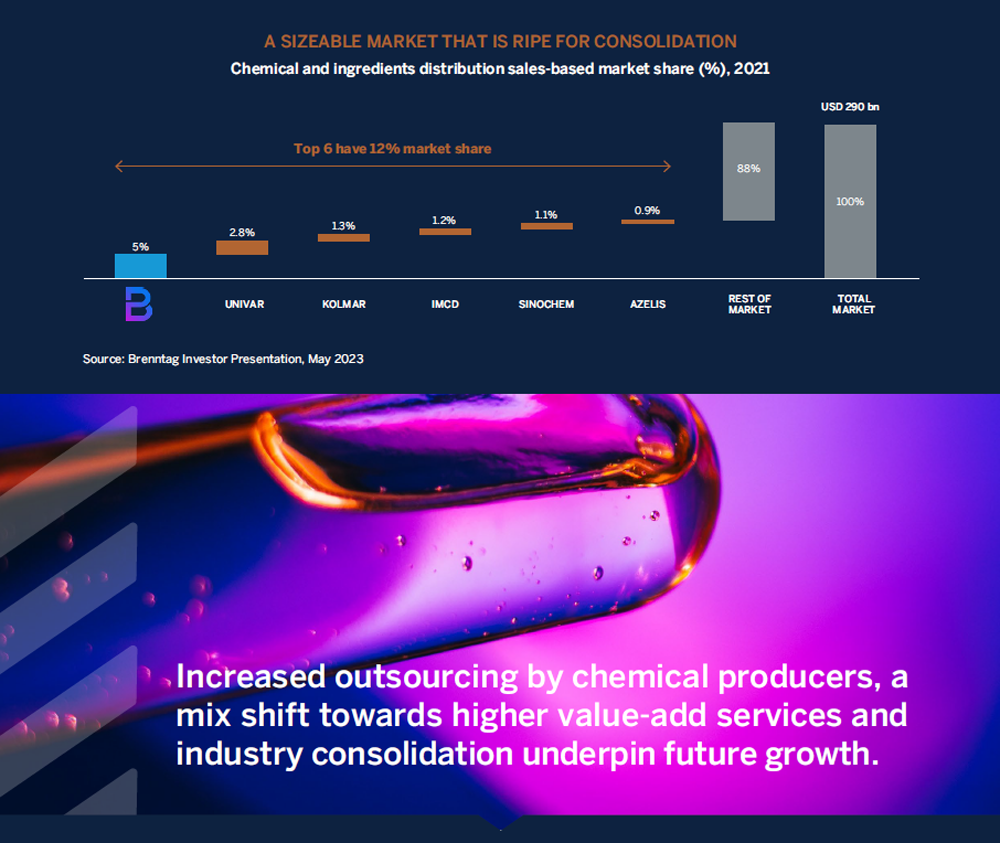

Consolidating “mom-and-pop” distributors is another opportunity to capture growth. Brenntag is the market leader commanding only 5% share in a total addressable market worth USD 290 billion. As shown in the chart below, the industry remains highly fragmented. Brenntag’s strong balance sheet provides plenty room to execute on their strategy as the leading consolidator, resulting in further scale benefits.

Defensive offense – a quality cyclical

Brenntag forms part of the cyclical exposure in the fund. It is a unique blend in that it offers a geared play on economic growth while being relatively protected on the downside, as proven in past recessions.

The structural tailwind supporting increased outsourcing, defensive-end markets within specialty chemicals, and small but frequent order sizes contribute to resilient sales. Costs are variable and ongoing productivity efforts laid out in its transformation program add additional earnings stability.

Combining this with the capital light nature of the business model produces far more stable returns on investment than a typical company operating in the materials sector. Investors have been rewarded with operating profits and dividends growing 9% per annum and 13% per annum respectively since the company publicly listed in 2010. Brenntag has found the right chemical formula for making money no matter where we are in the cycle.