From our Fund Manager’s Desk

Biodiversity: Meet the new climate

Biodiversity preservation is one of the most pressing issues of our time. The loss of biodiversity poses a serious threat to the stability and resilience of natural systems. These systems provide essential services and resources for human well-being such as food, water, medicine, and climate regulation. Recently there has been a growing realisation that biodiversity preservation is at least as important as climate change. In some regards, it may be considered even more critical, given that biodiversity loss is irreversible while some of the effects of climate change can be mitigated. Biodiversity is a term that describes the variety of plant and animal life on Earth. Ecosystems, which are communities of interacting organisms and their environment, are under threat from human activities such as land use change, overexploitation, pollution, and climate change. For example, deforestation increases the risk of infectious diseases as human and wild-animal habitats converge; loss of insects affects global food security, and the loss of biodiverse genetic material limits the development of new medicines and vaccines. Despite its importance, biodiversity is in crisis. The UN reports that the rate of species extinction is now 100 to 1,000 times higher than the natural rate, with 1 in 4 species at risk of extinction.

The loss of biodiversity has significant implications for the economy and society and undermines the livelihoods and well-being of millions.

Partial biodiversity collapse could trim global GDP growth by 2.3% p.a., resulting in a potential economic loss of USD 18 trillion through to 2030. Land and oceanic degradation are estimated to cost a further USD 6 trillion annually.

In addition to the direct economic impacts, biodiversity loss has indirect financial consequences. The disruption of ecosystems increases the risk of natural disasters, such as floods and landslides, which cause significant damage to infrastructure and property. This impacts insurance premiums and the cost of financing for businesses and governments.

Biodiversity loss represents one of the greatest global risks over the next decade. As our planet approaches the brink of irreversible change, policymakers have acknowledged that financial systems need to play a role in safeguarding nature. The main outcome of COP15, the UN Biodiversity Conference held in Montreal in December 2022, was the adoption of a global action plan for nature. From an investor focus perspective, COP 15 is expected to represent for biodiversity what the Paris Agreement (COP21) was to climate change. The conference resulted in 126 financial institutions, representing over USD 20 trillion in assets under management (AUM), signing the Finance for Biodiversity Pledge committing themselves to setting their own biodiversity targets, with reporting commitments, by 2024.

COP15 aims to reverse biodiversity loss by 2030, and this will lead to increasing regulation and improved biodiversity reporting standards. Two key reporting initiatives come to mind. Firstly, the IFRS Sustainability Disclosure Standards (IFRS SDS) is expected to become effective on 1 January 2024 and will apply to all entities that report according to IFRS Accounting Standards. The goal is to elevate biodiversity disclosure alongside climate disclosure.

The second initiative is the Taskforce on Naturerelated Financial Disclosures (TNFD), developed to meet the growing need to factor nature into financial and business decisions. The TNFD framework, expected in September 2023, will include disclosure recommendations for both impacts and dependencies on nature, as well as guidance on setting sciencebased targets for nature. Currently, most corporates have emission-reduction goals, but only 5% have biodiversity goals. It is obvious that the impact of biodiversity on society and the economy is becoming more important and will likely receive as much attention as climate change.

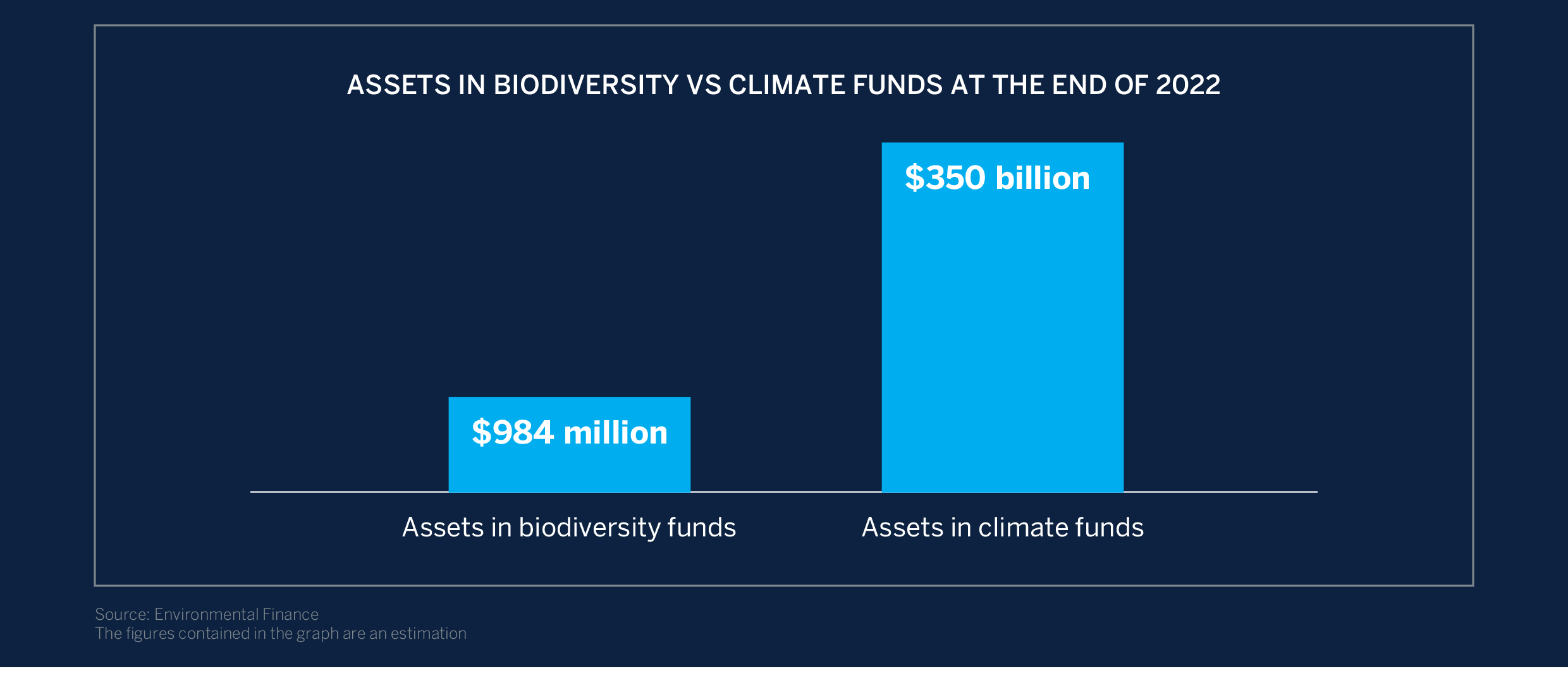

The Paulson Institute estimates that an incremental annual investment of USD 0.9 trillion is needed to improve biodiversity, and that only 10% of the annual investment needed to reverse nature loss is being met today. Clearly, the financing needs to restore and sustainably manage our planet’s ecosystems offers significant opportunities for investors and society. Research by Environmental Finance highlights that currently only USD 984 million of AUM is invested in biodiversityfocused funds, compared to USD 350 billion invested in climate-focused funds.

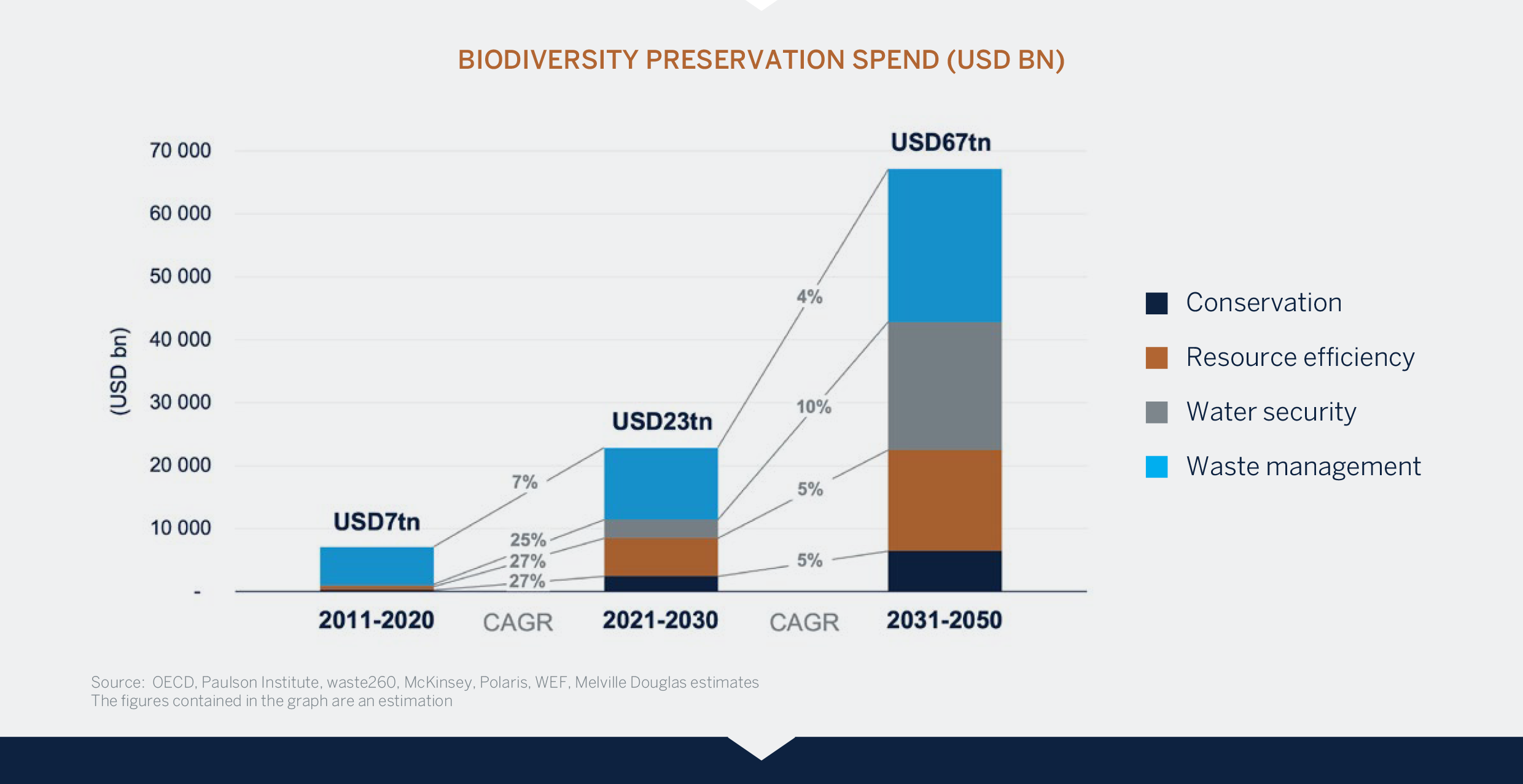

Given that financial investors are increasingly seeing its importance, Melville Douglas expects significant growth in biodiversity focused investments. In the Melville Douglas Global Impact Fund, our Biodiversity Preservation investment theme focuses on opportunities in water treatment, sustainable waste disposal, recycling/the circular economy, and resource efficiency. We estimate that our investment sub-themes together represent a USD 90 trillion investment opportunity through to 2050.

The Global Impact Fund currently invests in several innovative companies that seek to solve the world’s biggest biodiversity challenges. Neste is an example of one such investment. As a global leader in renewable and circular solutions producing low-emission fuels from waste and residue fats, Neste has repurposed 3.4 million tonnes of waste – equivalent to the waste generated by 12.6 million people. The fund also holds an investment in Novozymes, a leading global biotechnology company that produces enzymes for industrial use. Enzymes are natural, biodegradable proteins used to achieve greater yields, produce better product performance, or to lower production costs. All of their solutions seek to maximise resource efficiency. These are just two examples of how our investee companies contribute to biodiversity preservation and aim to generate positive social and environmental outcomes, alongside financial returns. With the potential impact of biodiversity loss on the global economy and investor returns, our world is facing a new set of risks and associated opportunities, and your investments need to adapt. The Melville Douglas Global Impact Fund offers you a unique opportunity to align your values with your investments. By investing in nature, we can create a more resilient and prosperous future for ourselves and generations to come. Join us in delivering on a shared objective of growing your wealth while making a positive impact, the Melville Douglas way.